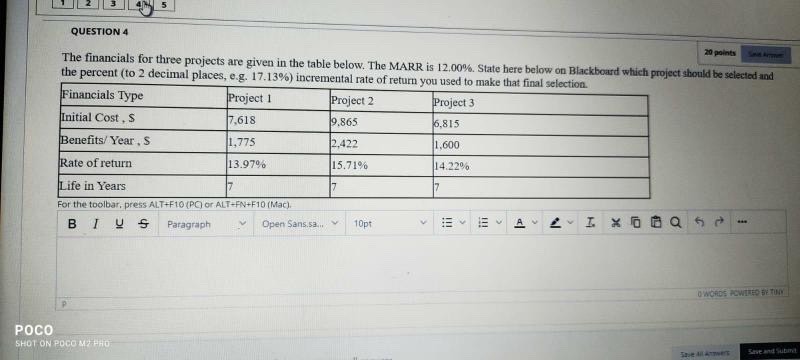

Question: 5 QUESTION 4 30 points The financials for three projects are given in the table below. The MARR is 12,00%. State here below on Blackboard

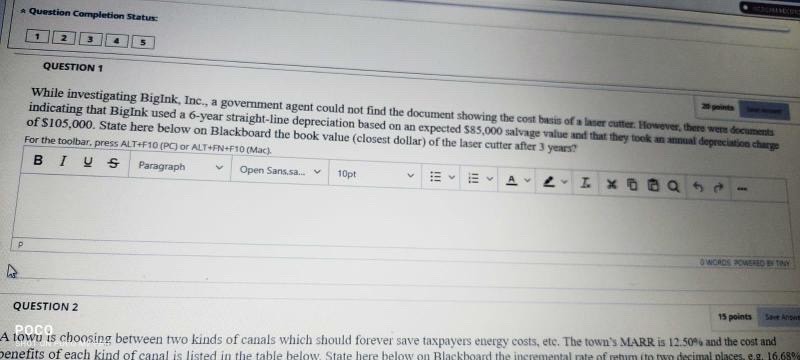

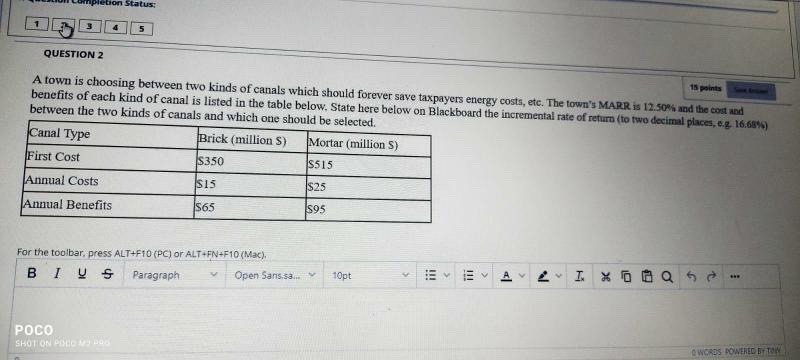

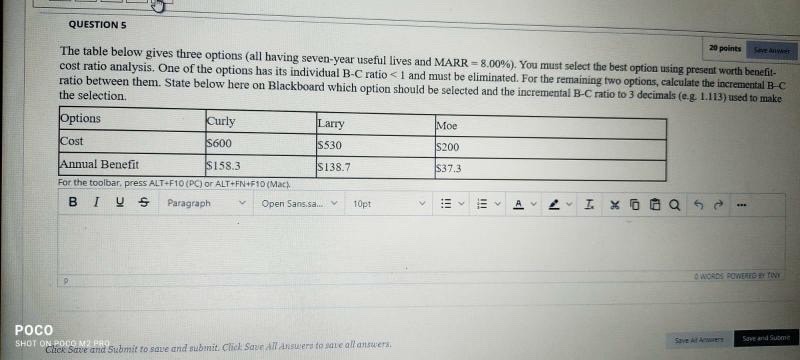

5 QUESTION 4 30 points The financials for three projects are given in the table below. The MARR is 12,00%. State here below on Blackboard which project should be selected and the percent (to 2 decimal places, e.g. 17.13%) incremental rate of return you used to make that final selection. Financials Type Project 1 Project 2 Project 3 Initial Cost , $ 7.618 9.865 6.815 Benefits/ Year . S 1,775 2,422 1.600 Rate of return 13.97% 15.71% 14.22% Life in Years 17 7 For the toolbar, press ALT+F10 (PC) or ALT-FN+F10 (Mar). BIUS Paragraph Open Sans.53... 10pt O WORDS POWIRED BE TUM POCO SHOT ON POCO MY PHOA Question Completion Status: QUESTION 1 While investigating Bigink, Inc., a government agent could not find the document showing the cost basis of a laser cutter. However, there were documents indicating that BigInk used a 6-year straight-line depreciation based on an expected $85,000 salvage value and that they took an annual depreciation charge of $105.000. State here below on Blackboard the book value (closest dollar) of the laser cutter after 3 years. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mack. BIUS Paragraph Open Sans.sal.. v 10pt Ev Ev A v 15 points QUESTION 2 A town is choosing between two kinds of canals which should forever save taxpayers energy costs, etc. The town's MARR is 12.50% and the cost and benefits of each kind of canal is listed in the table below. State here below on Blackboard the incremental rate of return (to twin decimal places. elg. 16.6808ction Status; 5 QUESTION 2 15 points A town is choosing between two kinds of canals which should forever save taxpayers energy costs, etc. The town's MARR is 12.50%% and the cost and benefits of each kind of canal is listed in the table below. State here below on Blackboard the incremental rate of return (to two decimal places, e.g. 16.68%%) between the two kinds of canals and which one should be selected Canal Type Brick (million $) Mortar ( million 5) First Cost $350 $515 Annual Costs $15 $25 Annual Benefits $65 595 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Open Sans sal.. #10pt POCO SHOT ON POLO MY Baby WORDS POWERED ET TONQUESTION 5 20 points The table below gives three options (all having seven-year useful lives and MARR = 8.00%). You must select the best option using present worth benefit- cost ratio analysis. One of the options has its individual B-C ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts