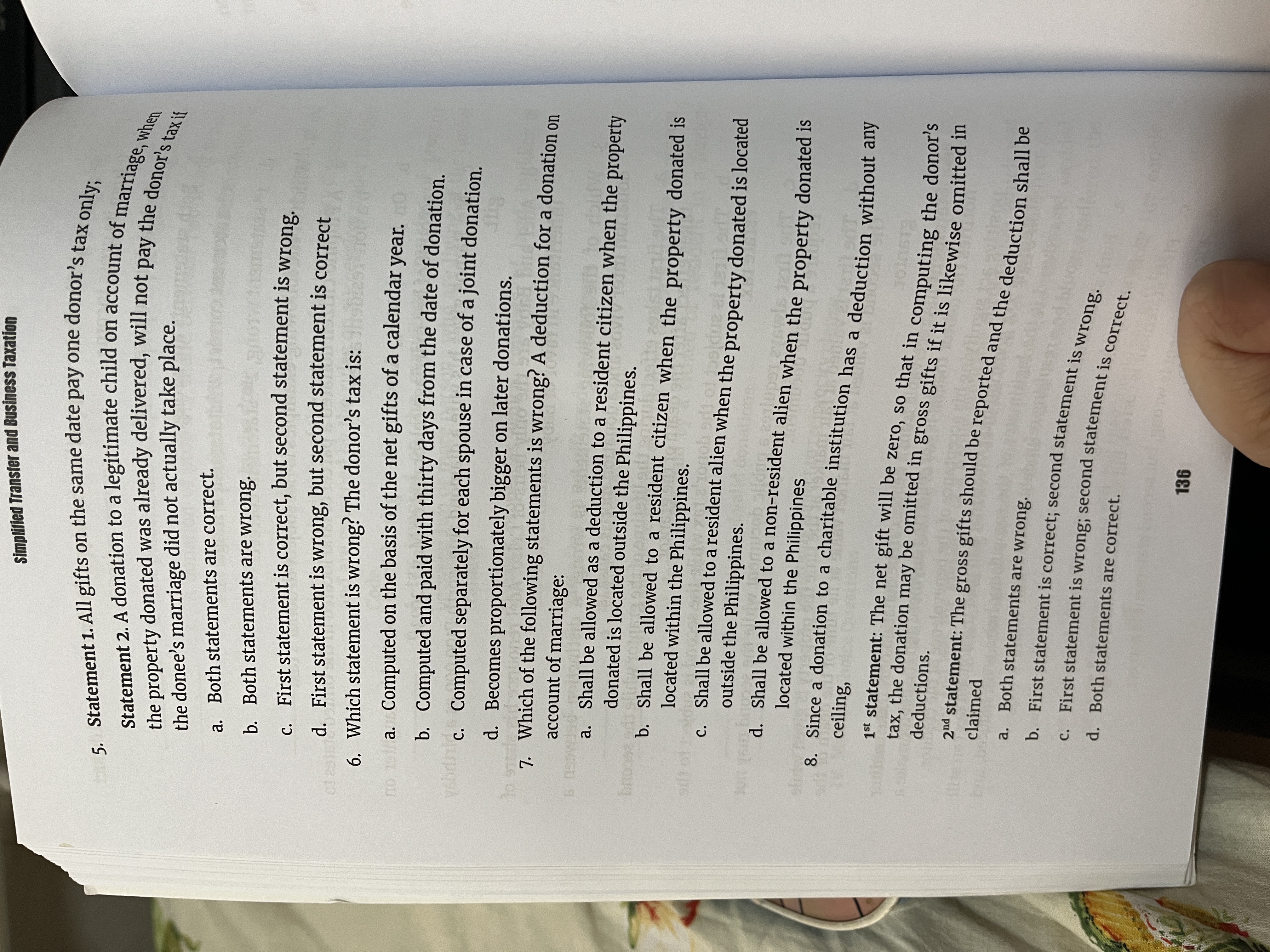

Question: 5 . Statement 1 All gifts on the same date pay one conor's tax only; statement 2 A donation to legitimated, will coupt of marriage,

Statement All gifts on the same date pay one conor's tax only; statement A donation to legitimated, will coupt of marriage, he the property donated was already delivered aer not pay the donor's taxi the donee's marriage did not actually take place.

ABoth statements are correct.

BBoth statements are wrong.

CFirst statement is correct, but second statement is wrong.

DFirst statement is wrong, but second statement is correct.

Which statement is wrong? The donor's tax is:

AComputed on the basis of the net gifts of a calendar year.

BComputed and paid with thirty days from the date of donation.

CComputed separately for each spouse in case of a joint donation.

DBecomes proportionately bigger on later donations.

Which of the following statements is wrong? A deduction for a donation on account of marriage:

AShall be allowed as a deduction to a resident citizen when the property donated is located outside the Philippines.

BShall be allowed to a resident citizen when the property donated is located within the Philippines.

CShall be allowed to a resident alien when the property donated is located outside the Philippines.

DShall be allowed to a nonresident alien when the property donated is located within the Philippines.

Since a donation to a charitable institution has a deduction without any ceiling,

st statement: The net gift will be zero, so that in computing the donor's tax, the donation may be omitted in gross gifts if it is likewise omitted in deductions.

nd statement: The gross gifts should be reported and the deduction shall be claimed.

a Both statements are wrong.

b First statement is correct; second statement is wrong.

C First statement is wrong; second statement is correct.

d Both statements are correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock