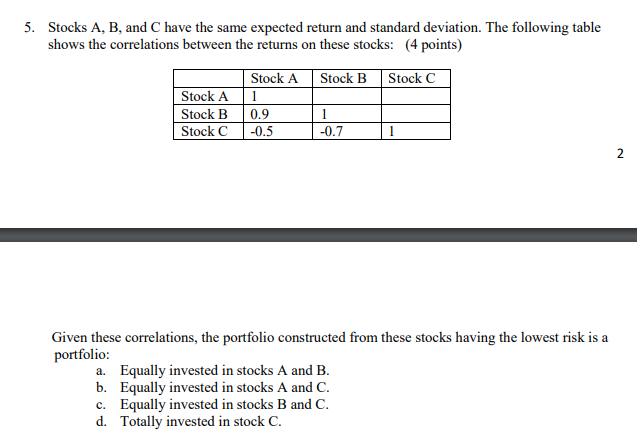

Question: 5. Stocks A, B, and C have the same expected return and standard deviation. The following table shows the correlations between the returns on these

5. Stocks A, B, and C have the same expected return and standard deviation. The following table shows the correlations between the returns on these stocks: (4 points) Stock A Stock B Stock C Stock A 1 Stock B 0.9 1 Stock C -0.5 -0.7 1 3 Given these correlations, the portfolio constructed from these stocks having the lowest risk is a portfolio: a. Equally invested in stocks A and B. b. Equally invested in stocks A and C. c. Equally invested in stocks B and C. d. Totally invested in stock C.

5. Stocks A, B, and C have the same expected return and standard deviation. The following table shows the correlations between the returns on these stocks: (4 points} _ "IE- ___I_ lGiven these correlations, the portfolio constructed 'ont these stocks having the lowest risk is a portfolio: 3. Equally invested in stocks A and E. h. Equally invested in stocks A and C. c. Equally invested in stocks B and C. d. Totally invested in stool; C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts