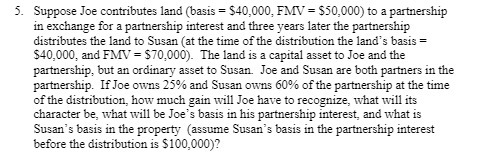

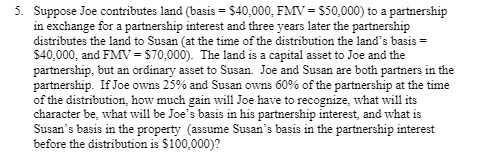

Question: 5. Suppose Joe contributes land (basis = $40,000, FMV = $50,000) to a partnership in exchange for a partnership interest and three years later the

5. Suppose Joe contributes land (basis = $40,000, FMV = $50,000) to a partnership in exchange for a partnership interest and three years later the partnership distributes the land to Susan (at the time of the distribution the land's basis = $40,000, and FMV = $70,000). The land is a capital asset to Joe and the partnership, but an ordinary asset to Susan. Joe and Susan are both partners in the partnership. If Joe owns 25% and Susan owns 60% of the partnership at the time of the distribution, how much gain will Joe have to recognize, what will its character be, what will be Joe's basis in his partnership interest, and what is Susan's basis in the property (assume Susan's basis in the partnership interest before the distribution is $100,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts