Question: 5. Test Your Knowledge The maturity date of a note receivable: A. Is the day of the credit sale B. Is the day the note

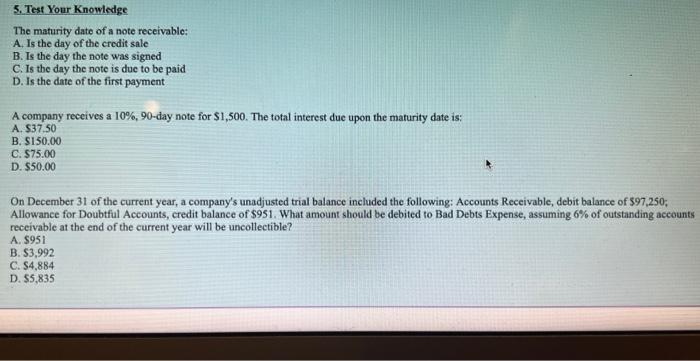

5. Test Your Knowledge The maturity date of a note receivable: A. Is the day of the credit sale B. Is the day the note was signed C. Is the day the note is due to be paid D. Is the date of the first payment A company receives a 10%,90-day note for $1,500. The total interest due upon the maturity date is: A. $37.50 B. $150.00 C. $75.00 D. $50.00 On December 31 of the current year, a company's unadjusted trial balance included the following: Accounts Receivable, debit balance of 597,250 ; Allowance for Doubtful Accounts, credit balance of \$951. What amount should be debited to Bad Debts Expense, assuming 6% of outstanding accounts receivable at the end of the current year will be uncollectible? A. $951 B. $3,992 C. $4,884 D. 55,835

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts