Question: 5. The bank statement balance of $7,000 does not include a check outstand- ing of $1,000, a deposit in transit of $275, and another company's

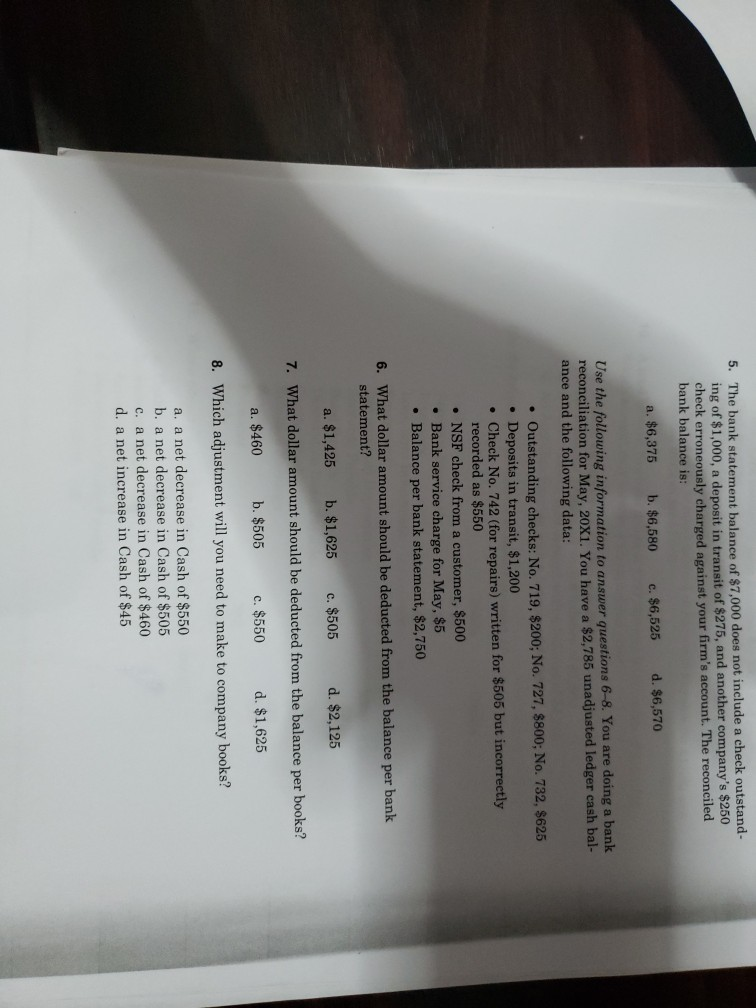

5. The bank statement balance of $7,000 does not include a check outstand- ing of $1,000, a deposit in transit of $275, and another company's $250 check erroneously charged against your firm's account. The reconciled bank balance is: a. $6,375 b. $6,580 c. $6,525 d. $6,570 Use the following information to answer questions 6-8. You are doing a bank reconciliation for May, 20X1. You have a $2,785 unadjusted ledger cash bal- ance and the following data: Outstanding checks: No. 719, $200; No. 727, $800; No. 732, $625 Deposits in transit, $1,200 . Check No. 742 (for repairs) written for $505 but incorrectly recorded as $550 NSF check from a customer, $500 Bank service charge for May, $5 Balance per bank statement, $2,750 6. What dollar amount should be deducted from the balance per bank statement? a. $1,425 b. $1,625 c. $505 d. $2,125 7. What dollar amount should be deducted from the balance per books? a. $460 b. $505 c. $550 d. $1,625 8. Which adjustment will you need to make to company books? a. a net decrease in Cash of $550 b. a net decrease in Cash of $505 c. a net decrease in Cash of $460 d. a net increase in Cash of $45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts