Question: 5. The data in the next table reflects the conditions for settlement on October 8, 1985. Coupon Maturity Price 9% 9-30-1987 100 3 /32 10

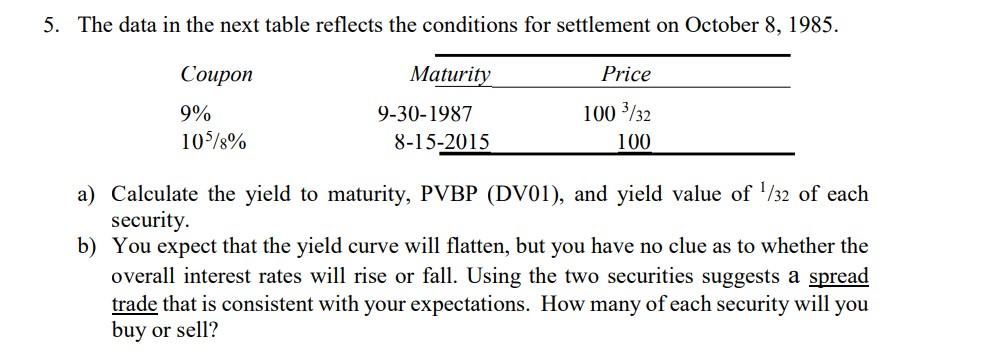

5. The data in the next table reflects the conditions for settlement on October 8, 1985. Coupon Maturity Price 9% 9-30-1987 100 3 /32 10 5 /8% 8-15-2015 100 a) Calculate the yield to maturity, PVBP (DV01), and yield value of 1 /32 of each security. b) You expect that the yield curve will flatten, but you have no clue as to whether the overall interest rates will rise or fall. Using the two securities suggests a spread trade that is consistent with your expectations. How many of each security will you buy or sell?

The data in the next table reflects the conditions for settlement on October 8,1985 . a) Calculate the yield to maturity, PVBP (DV01), and yield value of 1/32 of each security. b) You expect that the yield curve will flatten, but you have no clue as to whether the overall interest rates will rise or fall. Using the two securities suggests a spread trade that is consistent with your expectations. How many of each security will you buy or sell? The data in the next table reflects the conditions for settlement on October 8,1985 . a) Calculate the yield to maturity, PVBP (DV01), and yield value of 1/32 of each security. b) You expect that the yield curve will flatten, but you have no clue as to whether the overall interest rates will rise or fall. Using the two securities suggests a spread trade that is consistent with your expectations. How many of each security will you buy or sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts