Question: 5. The lessor's lease evaluation Aa Aa There are two parties in any lease contract-the lessee and the lessor. To a lessor, a lease analysis

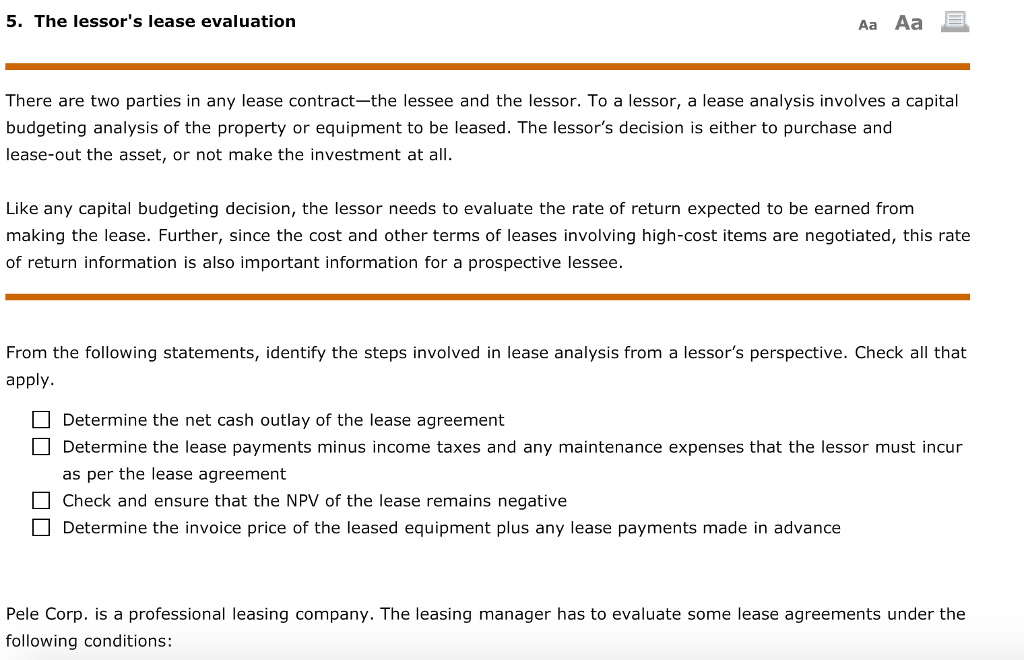

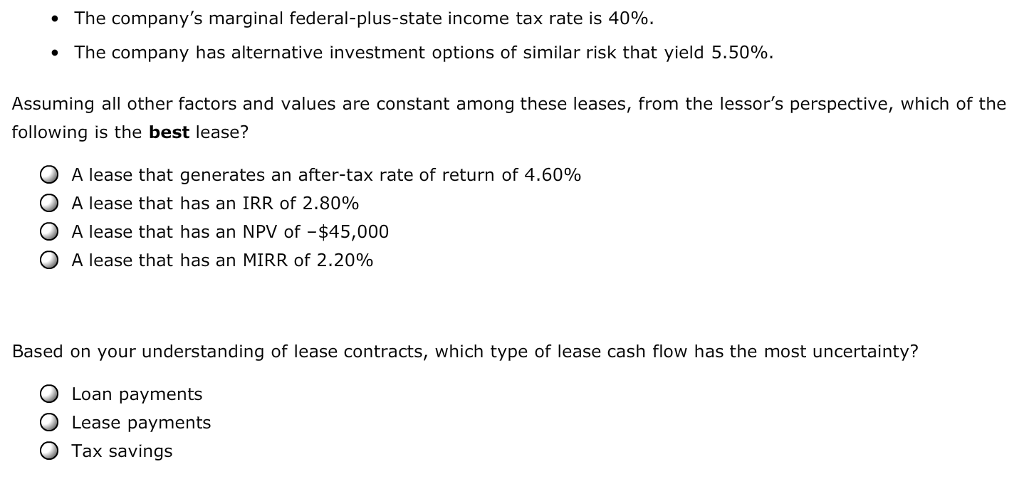

5. The lessor's lease evaluation Aa Aa There are two parties in any lease contract-the lessee and the lessor. To a lessor, a lease analysis involves a capital budgeting analysis of the property or equipment to be leased. The lessor's decision is either to purchase and lease-out the asset, or not make the investment at all Like any capital budgeting decision, the lessor needs to evaluate the rate of return expected to be earned from making the lease. Further, since the cost and other terms of leases involving high-cost items are negotiated, this rate of return information is also important information for a prospective lessee. From the following statements, identify the steps involved in lease analysis from a lessor's perspective. Check all that apply. Determine the net cash outlay of the lease agreement ? Determine the lease payments minus income taxes and any maintenance expenses that the lessor must incur as per the lease agreement Check and ensure that the NPV of the lease remains negative Determine the invoice price of the leased equipment plus any lease payments made in advance Pele Corp. is a professional leasing company. The leasing manager has to evaluate some lease agreements under the following conditions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts