Question: 5. This is a question about amortization. Amortization is an accounting technique used to lower the book value of a loan over the life of

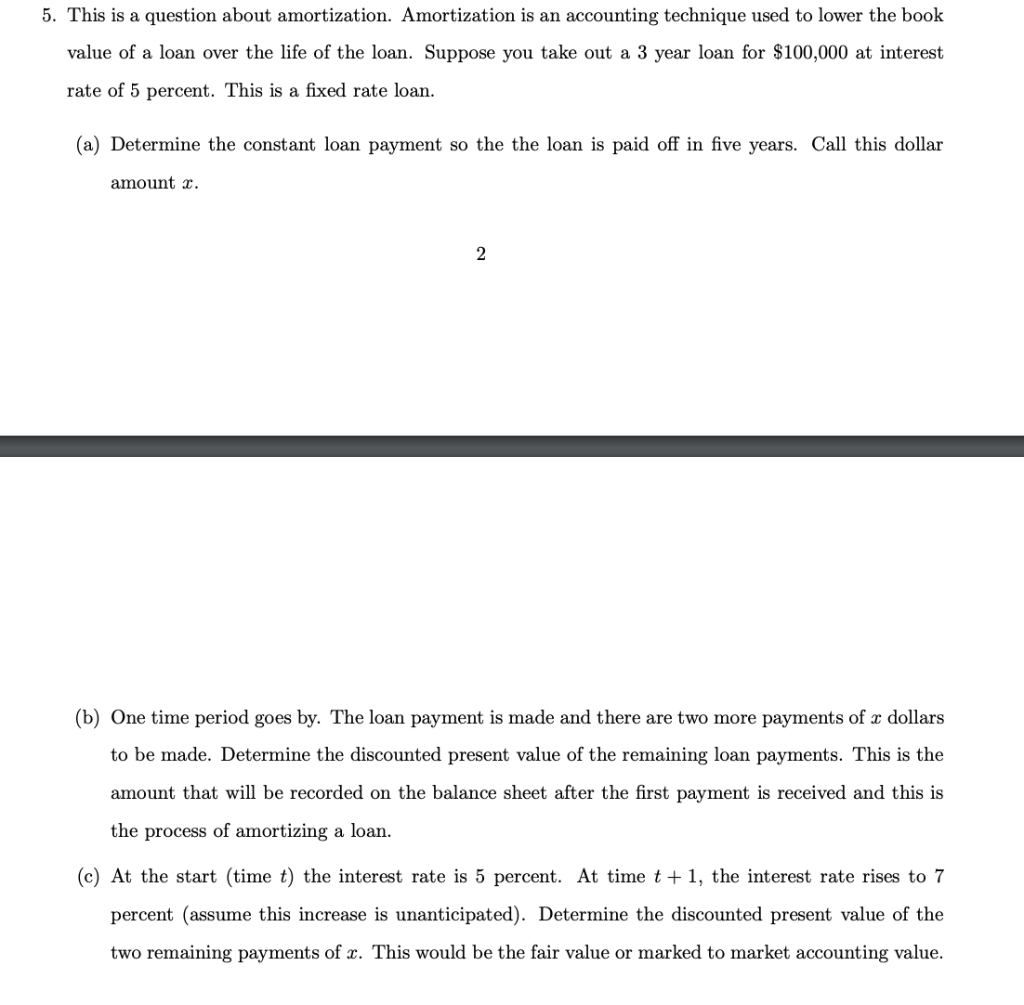

5. This is a question about amortization. Amortization is an accounting technique used to lower the book value of a loan over the life of the loan. Suppose you take out a 3 year loan for $100,000 at interest rate of 5 percent. This is a fixed rate loan. (a) Determine the constant loan payment so the the loan is paid off in five years. Call this dollar amount r. 2 (b) One time period goes by. The loan payment is made and there are two more payments of x dollars to be made. Determine the discounted present value of the remaining loan payments. This is the amount that will be recorded on the balance sheet after the first payment is received and this is the process of amortizing a loan. (c) At the start (time t) the interest rate is 5 percent. At time t +1, the interest rate rises to 7 percent (assume this increase is unanticipated). Determine the discounted present value of the two remaining payments of x. This would be the fair value or marked to market accounting value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts