Question: 5. This question concerns options and derivatives. a. Name two direction neutral strategies designed to make money under conditions of high volatility and sketch a

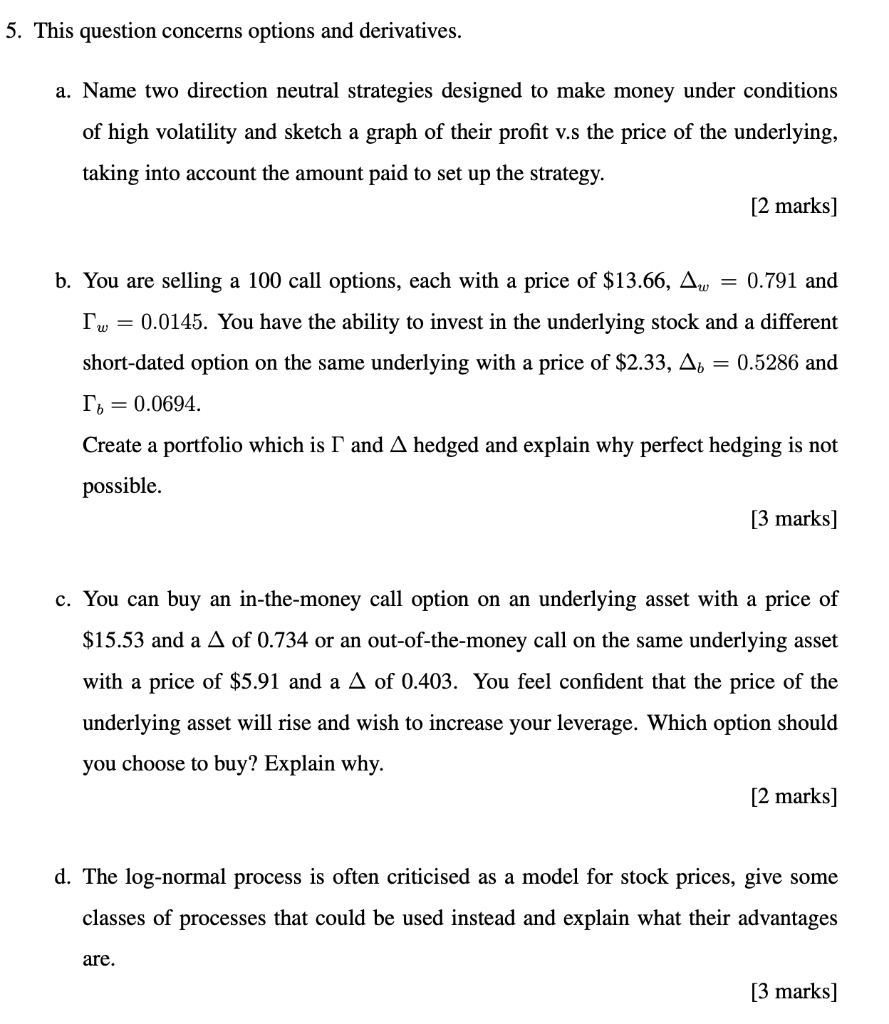

5. This question concerns options and derivatives. a. Name two direction neutral strategies designed to make money under conditions of high volatility and sketch a graph of their profit v.s the price of the underlying, taking into account the amount paid to set up the strategy. [2 marks] b. You are selling a 100 call options, each with a price of $13.66, Aw = 0.791 and Tw = 0.0145. You have the ability to invest in the underlying stock and a different short-dated option on the same underlying with a price of $2.33, A6 = 0.5286 and To = 0.0694. Create a portfolio which is I and A hedged and explain why perfect hedging is not possible. [3 marks] c. You can buy an in-the-money call option on an underlying asset with a price of $15.53 and a A of 0.734 or an out-of-the-money call on the same underlying asset with a price of $5.91 and a A of 0.403. You feel confident that the price of the underlying asset will rise and wish to increase your leverage. Which option should you choose to buy? Explain why. [2 marks] d. The log-normal process is often criticised as a model for stock prices, give some classes of processes that could be used instead and explain what their advantages are. [3 marks] 5. This question concerns options and derivatives. a. Name two direction neutral strategies designed to make money under conditions of high volatility and sketch a graph of their profit v.s the price of the underlying, taking into account the amount paid to set up the strategy. [2 marks] b. You are selling a 100 call options, each with a price of $13.66, Aw = 0.791 and Tw = 0.0145. You have the ability to invest in the underlying stock and a different short-dated option on the same underlying with a price of $2.33, A6 = 0.5286 and To = 0.0694. Create a portfolio which is I and A hedged and explain why perfect hedging is not possible. [3 marks] c. You can buy an in-the-money call option on an underlying asset with a price of $15.53 and a A of 0.734 or an out-of-the-money call on the same underlying asset with a price of $5.91 and a A of 0.403. You feel confident that the price of the underlying asset will rise and wish to increase your leverage. Which option should you choose to buy? Explain why. [2 marks] d. The log-normal process is often criticised as a model for stock prices, give some classes of processes that could be used instead and explain what their advantages are. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts