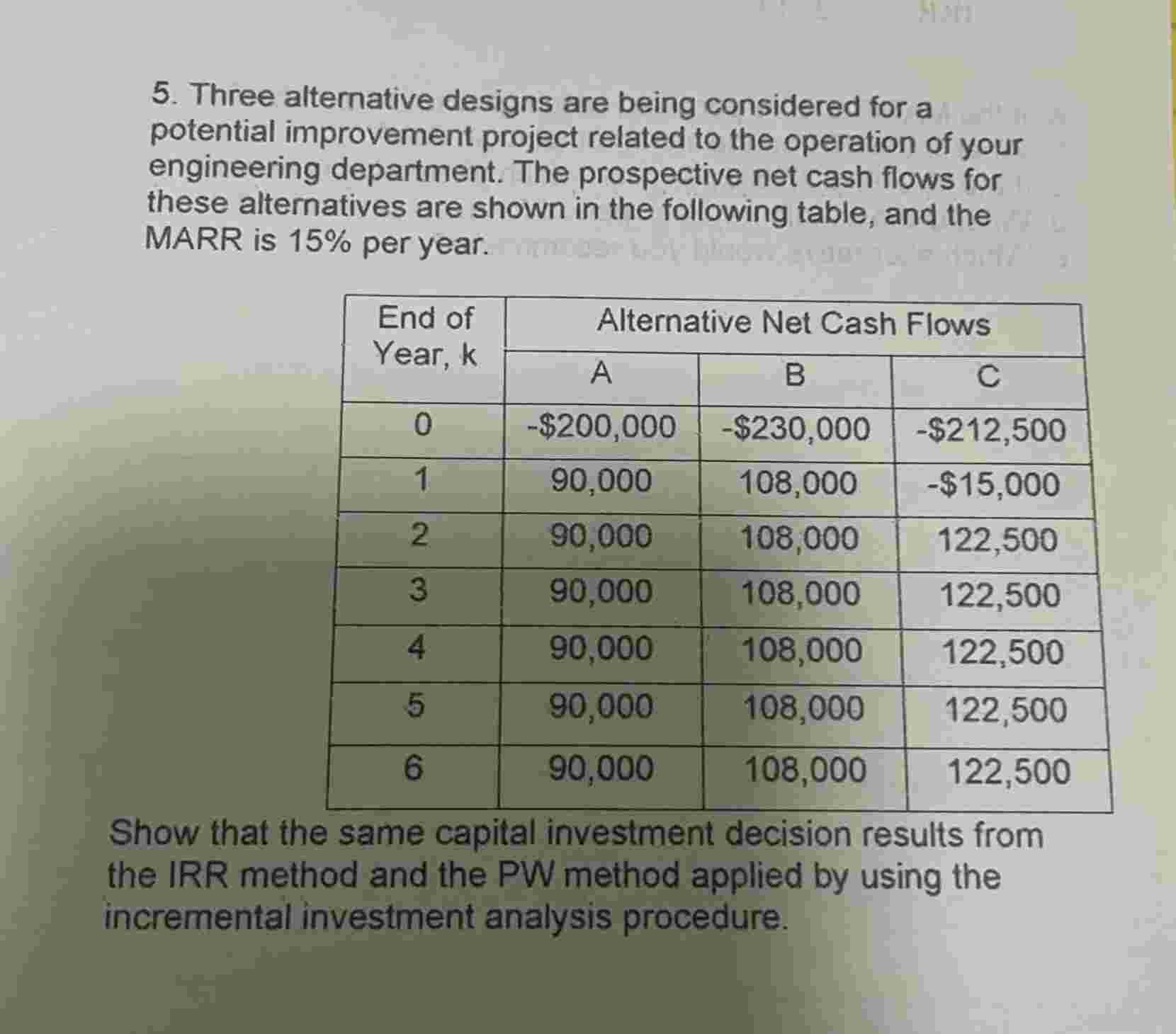

Question: 5 . Three alternative designs are being considered for a potential improvement project related to the operation of your engineering department. The prospective net cash

Three alternative designs are being considered for a potential improvement project related to the operation of your engineering department. The prospective net cash flows for these alternatives are shown in the following table, and the MARR is per year. begintabularllllhline multirowEnd of Year, k & multicolumncAlternative Net Cash Flowshline & A & B & C hline & $ & $ & $hline & & & $hline & & & hline & & & hline & & & hline & & & hline & & & hline endtabular Show that the same capital investment decision results from the IRR method and the PW method applied by using the incremental investment analysis procedure.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock