Question: 5 ... transactions, post, and prepare a stockholders' equity section; calculate ratios. Journalize P11.2 (LO 2, 3, 4), AP The stockholders' equity accounts of Cyrus

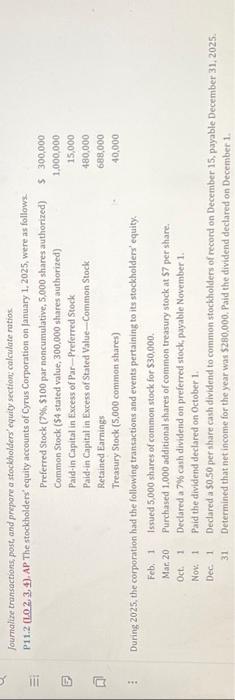

Journalize transactions, post, and prepare a stockholders' equity section; calculate ratios P11.2 (10.2,3,4). AP The stockholders' equity accounts of Cyrus Corporation on January 1, 2025, were as follows. Preferred Stock (7%, $100 par noncumulative, 5,000 shares authorized) Common Stock ($4 stated value, 300,000 shares authorized) Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (5,000 common shares) During 2025, the corporation had the following transactions and events pertaining to its stockholders' equity. Issued 5,000 shares of common stock for $30,000. Purchased 1.000 additional shares of common treasury stock at $7 per share. Declared a 7% cash dividend on preferred stock, payable November 1. Feb. 1 Mar. 20 Oct. 1 Nov. 1 Paid the dividend declared on October 1. Dec. 1 31 $ 300,000 1,000,000 15,000 480,000 688,000 40,000 Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31, 2025. Determined that net income for the year was $280,000. Paid the dividend declared on December 1. th D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts