Question: 5. True or false: When dealing with Worker's Compensation, excess earnings refers to the total amount that exceeds the maximum assessable earnings for each employee

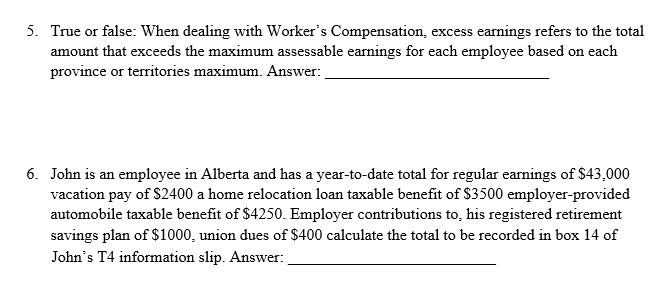

5. True or false: When dealing with Worker's Compensation, excess earnings refers to the total amount that exceeds the maximum assessable earnings for each employee based on each province or territories maximum. Answer: 6. John is an employee in Alberta and has a year-to-date total for regular earnings of $43,000 vacation pay of $2400 a home relocation loan taxable benefit of $3500 employer-provided automobile taxable benefit of $4250. Employer contributions to his registered retirement savings plan of $1000, union dues of $400 calculate the total to be recorded in box 14 of John's T4 information slip

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts