Question: A) Access financial data for Under Armour (UA) for the last two available years from the Securities and Exchange Commission (SEC). Data from the

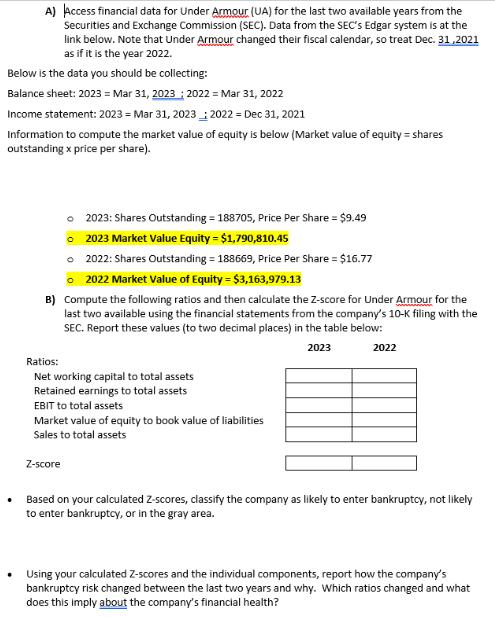

A) Access financial data for Under Armour (UA) for the last two available years from the Securities and Exchange Commission (SEC). Data from the SEC's Edgar system is at the link below. Note that Under Armour changed their fiscal calendar, so treat Dec. 31,2021 as if it is the year 2022. Below is the data you should be collecting: Balance sheet: 2023 = Mar 31, 2023 2022 = Mar 31, 2022 Income statement: 2023 = Mar 31, 2023 2022 = Dec 31, 2021 Information to compute the market value of equity is below (Market value of equity = shares outstanding x price per share). . 2023: Shares Outstanding - 188705, Price Per Share = $9.49 2023 Market Value Equity = $1,790,810.45 2022: Shares Outstanding = 188669, Price Per Share = $16.77 2022 Market Value of Equity = $3,163,979.13 B) Compute the following ratios and then calculate the Z-score for Under Armour for the last two available using the financial statements from the company's 10-K filing with the SEC. Report these values (to two decimal places) in the table below: 2023 Ratios: Net working capital to total assets Retained earnings to total assets EBIT to total assets Market value of equity to book value of liabilities Sales to total assets Z-score 2022 Based on your calculated Z-scores, classify the company as likely to enter bankruptcy, not likely to enter bankruptcy, or in the gray area. Using your calculated Z-scores and the individual components, report how the company's bankruptcy risk changed between the last two years and why. Which ratios changed and what does this imply about the company's financial health?

Step by Step Solution

There are 3 Steps involved in it

Here are the ratios and Zscores I calculated for Under Armour for 2023 and 2022 based on their finan... View full answer

Get step-by-step solutions from verified subject matter experts