Question: 5) Use the chart above to answer this question. I have a capital gains tax rate of 15% and a marginal normal tax rate of

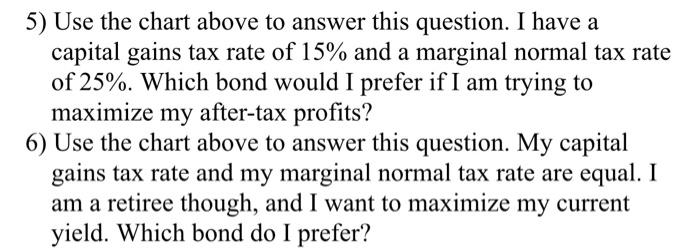

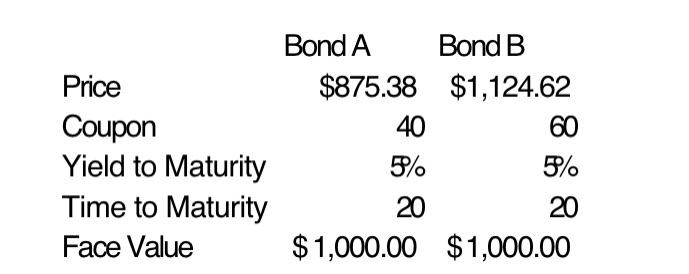

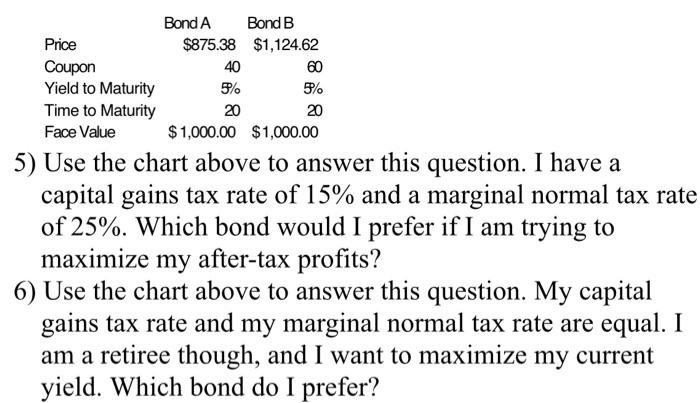

5) Use the chart above to answer this question. I have a capital gains tax rate of 15% and a marginal normal tax rate of 25%. Which bond would I prefer if I am trying to maximize my after-tax profits? 6) Use the chart above to answer this question. My capital gains tax rate and my marginal normal tax rate are equal. I am a retiree though, and I want to maximize my current yield. Which bond do I prefer? Price Coupon Yield to Maturity Time to Maturity Face Value Bond A Bond B $875.38 $1,124.62 40 60 5% 5% 20 20 $1,000.00 $1,000.00 Bond A Bond B Price $875.38 $1,124.62 Coupon 40 60 Yield to Maturity Time to Maturity 20 20 Face Value $1,000.00 $1,000.00 5) Use the chart above to answer this question. I have a capital gains tax rate of 15% and a marginal normal tax rate of 25%. Which bond would I prefer if I am trying to maximize my after-tax profits? 6) Use the chart above to answer this question. My capital gains tax rate and my marginal normal tax rate are equal. I am a retiree though, and I want to maximize my current yield. Which bond do I prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts