Question: 5) (Use the table below to answer this question.) Assume interest rate on long-term debt is 8%, and on short-term debt is 15%. Also assume

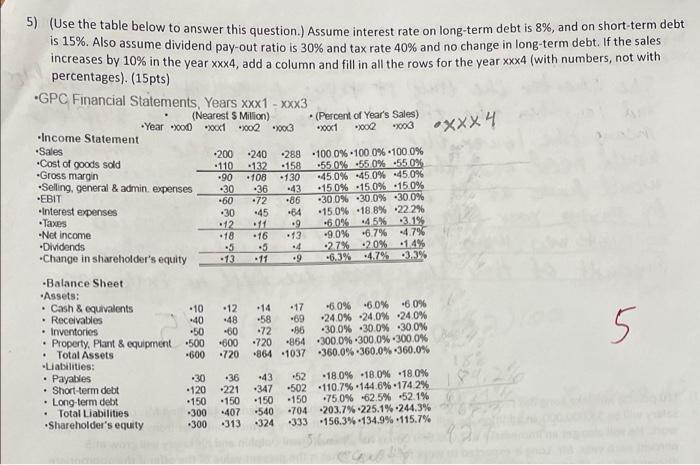

5) (Use the table below to answer this question.) Assume interest rate on long-term debt is 8%, and on short-term debt is 15%. Also assume dividend pay-out ratio is 30% and tax rate 40% and no change in long-term debt. If the sales increases by 10% in the year xxx4, add a column and fill in all the rows for the year xxx4 (with numbers, not with percentages). (15 pts) .GPC Financial Statements, Years xxx1 - xxx3 (Nearest s Million) (Percent of Year's Sales) -Income Statement Cost of goods sold Selling, general & admin. expenses Year x00 "xox1 02 03 *ooc1 002 2003 xxx .240 -132 . 108 .36 .72 -45 -60 -86 288.100 0% 100.0%.100.0% -158 -550% -550% -550% 130 -45.0% 45.0% 45.0% 15 0% 15,0% -150% -30 096 30.0% 30.0% -54 150% -18.8% 22.2% .9 -6.0% 14.5% 3.1% .13 -9.0% -6.7% -4.7% .4 27%20% .14% 9 -6.3% 4.7% 3.3% 16 -5 -11 Sales 200 -110 -Gross margin .90 .30 -EBIT Interest expenses .30 .Tas .12 -Net Income 18 Dividends -5 Change in shareholder's equity -13 -Balance Sheet Assets: Cash & equivalents . 10 .12 Receivables -40 -48 Inventories -50 -60 Property, Plant & equipment 500 .600 Total Assets -600 .720 Liabilities: Payables -30 +36 Short-term debt -120 221 . Long-term debt 150 -150 Total Liabilities -300 -407 Shareholder's equity -300 313 .14 .17 6.0% -60% -60% -58 -69 24.0% -24.0% -24.0% -72 -86 .30.0% -30.0% -30.0% -720 864 .300.0% 300.0% 300.0% *864 -1037-360.0% 360.0% 360.0% 5 -43 .347 150 540 -324 .52 -18.0% +18.0% 18.0% -502.110.7% 144.6%.174.2% - 150 75 0% 62.5% 52.1% -704 -203.7%.225.1% 244.3% - 333 -156.3%.134.9%.115.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts