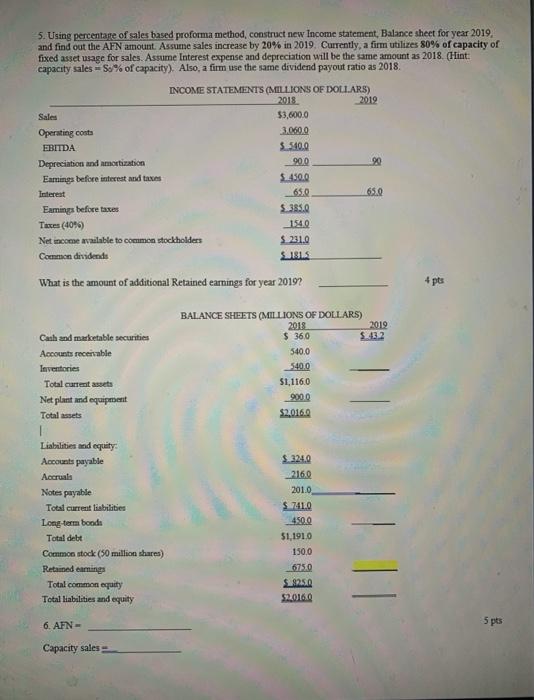

Question: 5. Using percentage of sales based proforma method, construct new Income statement, Balance sheet for year 2019, and find out the AFN amount. Assume sales

5. Using percentage of sales based proforma method, construct new Income statement, Balance sheet for year 2019, and find out the AFN amount. Assume sales increase by 20% in 2019. Currently, a firm utilizes 80% of capacity of fixed asset usage for sales. Assume Interest expense and depreciation will be the same amount as 2018. (Hint: capacity sales - So% of capacity). Also, a firm use the same dividend payout ratio as 2018 INCOME STATEMENTS (MILLIONS OF DOLLARS) 2018 2019 Sales $3,600.0 Operating costs 3.060.0 EBITDA 5.540.0 Depreciation and amortization 900 20 Earnings before interest and taxes 5.450,0 Interest 65.2 Eaminys before taxes 5.385.0 Taxes (409) 1540 Net income available to common stockholders 5.2012 Common dividends S1815 What is the amount of additional Retained earnings for year 20192 4 pts Cash and marketable securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets BALANCE SHEETS (MILLIONS OF DOLLARS) 2018 2019 $ 360 $1432 540,0 _5400 51,116,0 9000 $2,016.0 Liabilities and equity Accounts payable Accrual Notes payable Total current liabilities Long-term boods Total debt Common stock (50 million shares) Retained emings Total common equity Total liabilities and equity $ 2240 2160 2010 $ 741.0 4500 $1,1910 150,0 6750 $8250 520160 6. AEN- 5 pts Capacity sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts