Question: 5. Using regression analysis to forecast assets The AFN equation and the financial statement-forecasting approach both assume that assets grow at relatively the same rate

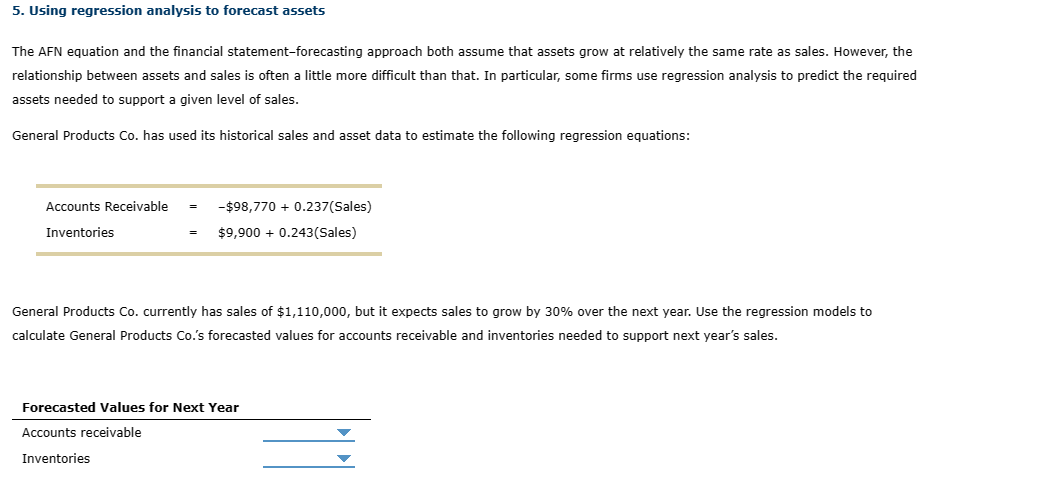

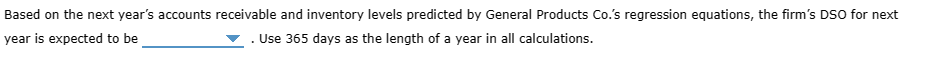

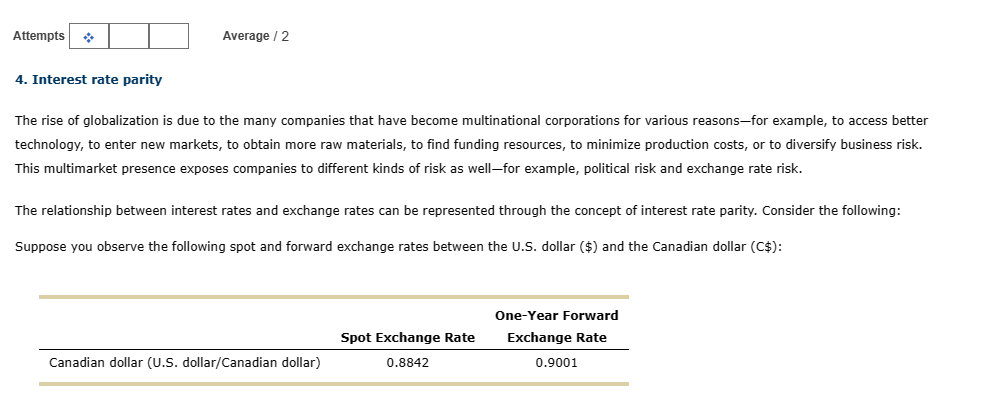

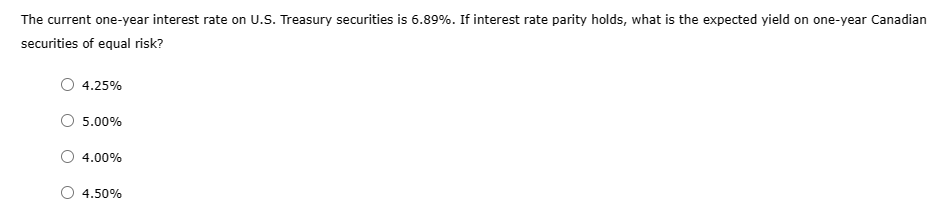

5. Using regression analysis to forecast assets The AFN equation and the financial statement-forecasting approach both assume that assets grow at relatively the same rate as sales. However, the relationship between assets and sales is often a little more difficult than that. In particular, some firms use regression analysis to predict the required assets needed to support a given level of sales. General Products Co. has used its historical sales and asset data to estimate the following regression equations: General Products Co. currently has sales of $1,110,000, but it expects sales to grow by 30% over the next year. Use the regression models to calculate General Products Co.'s forecasted values for accounts receivable and inventories needed to support next year's sales. Based on the next year's accounts receivable and inventory levels predicted by General Products Co.'s regression equations, the firm's DSO for next year is expected to be . Use 365 days as the length of a year in all calculations. 61.52 days 67.67 days 58.44 days 55.37 days The rise of globalization is due to the many companies that have become multinational corporations for various reasons-for example, to access better technology, to enter new markets, to obtain more raw materials, to find funding resources, to minimize production costs, or to diversify business risk. This multimarket presence exposes companies to different kinds of risk as well-for example, political risk and exchange rate risk. The relationship between interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: Suppose you observe the following spot and forward exchange rates between the U.S. dollar (\$) and the Canadian dollar (C\$): The current one-year interest rate on U.S. Treasury securities is 6.89%. If interest rate parity holds, what is the expected yield on one-year Canadian securities of equal risk? 4.25% 5.00% 4.00% 4.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts