Question: 5. Using the data given below, and the WACC=11.6%, calculate the Enterprise Value, Equity value, and value per share of the company assuming 10 million

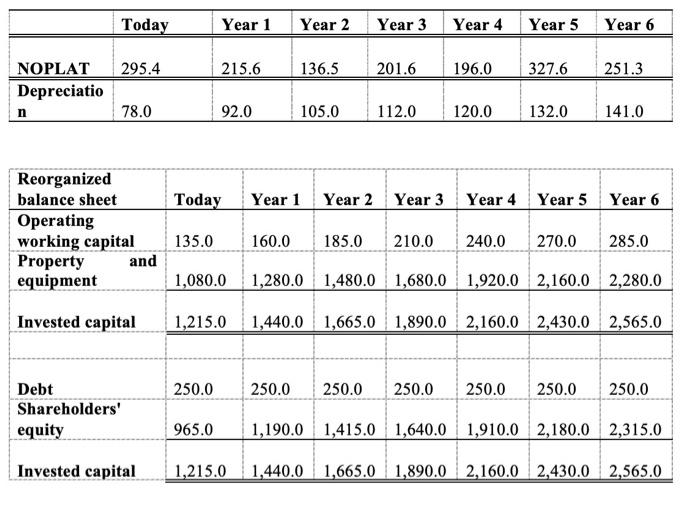

5. Using the data given below, and the WACC=11.6%, calculate the Enterprise Value, Equity value, and value per share of the company assuming 10 million shares outstanding, a growth rate=6%, and RONIC=18% (25 points) Today Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 295.4 215.6 136.5 201.6 196.0 327.6 251.3 NOPLAT Depreciatio n 78.0 92.0 105.0 112.0 120.0 132.0 141.0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Reorganized balance sheet Today Operating working capital 135.0 Property and equipment 1,080.0 160.0 185.0 210.0 240.0 270.0 285.0 1,280.0 1,480.0 1,680.0 1,920.0 2,160.0 2,280.0 Invested capital 1,215.0 1,440.0 1,665.0 1,890.0 2,160.0 2,430.0 2,565.0 250.0 250.0 250.0 250.0 250.0 250.0 250.0 Debt Shareholders' equity 965.0 1,190.0 1,415.0 1,640.0 1,910.0 2,180.0 2,315.0 Invested capital 1,215.0 1,440.0 1,665.0 1,890.0 2,160.0 2,430.0 2,565.0 5. Using the data given below, and the WACC=11.6%, calculate the Enterprise Value, Equity value, and value per share of the company assuming 10 million shares outstanding, a growth rate=6%, and RONIC=18% (25 points) Today Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 295.4 215.6 136.5 201.6 196.0 327.6 251.3 NOPLAT Depreciatio n 78.0 92.0 105.0 112.0 120.0 132.0 141.0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Reorganized balance sheet Today Operating working capital 135.0 Property and equipment 1,080.0 160.0 185.0 210.0 240.0 270.0 285.0 1,280.0 1,480.0 1,680.0 1,920.0 2,160.0 2,280.0 Invested capital 1,215.0 1,440.0 1,665.0 1,890.0 2,160.0 2,430.0 2,565.0 250.0 250.0 250.0 250.0 250.0 250.0 250.0 Debt Shareholders' equity 965.0 1,190.0 1,415.0 1,640.0 1,910.0 2,180.0 2,315.0 Invested capital 1,215.0 1,440.0 1,665.0 1,890.0 2,160.0 2,430.0 2,565.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts