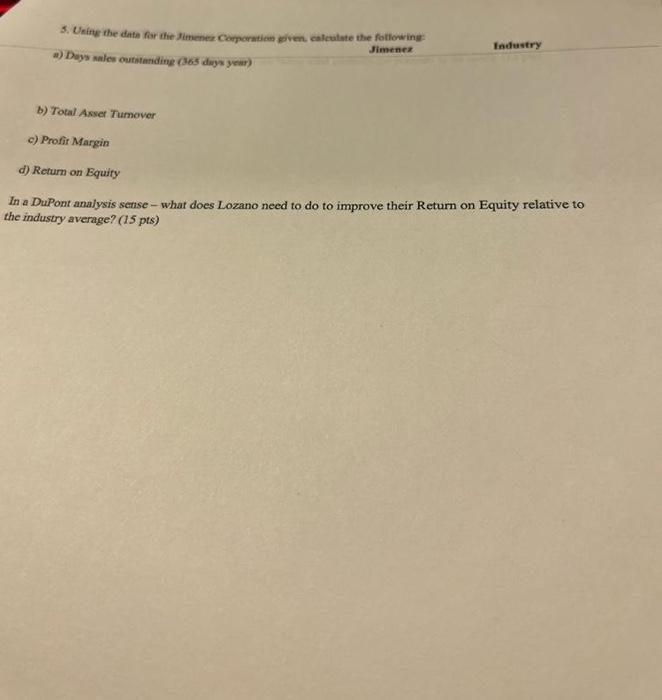

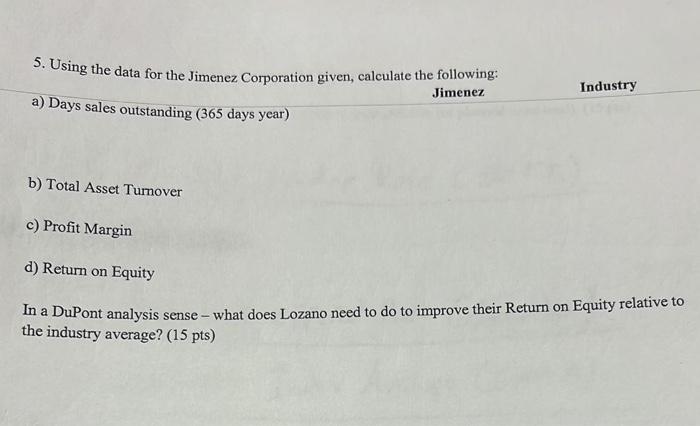

Question: 5. Using the date for the Jimenez Corporation given, calculate the following: Jimenez Industry a) Days sales outstanding (365 days year) b) Total Asset Turnover

5. Using the date for the Jimenez Corporation given, calculate the following: Jimenez Industry a) Days sales outstanding (365 days year) b) Total Asset Turnover c) Profit Margin d) Return on Equity In a DuPont analysis sense - what does Lozano need to do to improve their Return on Equity relative to the industry average?

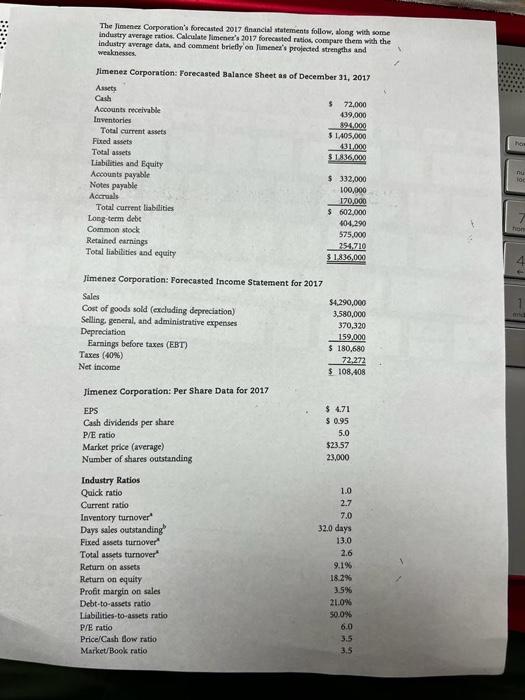

The Jimenex Corporation's forecasted 2017 financias statements follow, along with some induitry average ratios. Calculate limenex's 2017 forectuted ratios, compare them with the industry average data, and cocrment briefly on Jemesez's projected strengths and weiknesses. Jimezez Corporation: Forecasted Balance Sheet as of December 31, 2017 Jimenez Corporation: Forecasted income Statement for 2017 5. Urifte the ditta far the Jimenez Camoration kiven calculste the fotlowing: Industry a) Deys alles outntanding (365 ding year) b) Total Asser Tumover c) Profir Margin d) Return on Equity In a DuPont analysis sense - what does Lozano need to do to improve their Return on Equity relative to the industry average? ( 15 pts) 5. Using the data for the Jimenez Corporation given, calculate the following: Jimenez Industry a) Days sales outstanding ( 365 days year) b) Total Asset Turnover c) Profit Margin d) Return on Equity In a DuPont analysis sense - what does Lozano need to do to improve their Return on Equity relative to the industry average? ( 15pts) The Jimenex Corporation's forecasted 2017 financias statements follow, along with some induitry average ratios. Calculate limenex's 2017 forectuted ratios, compare them with the industry average data, and cocrment briefly on Jemesez's projected strengths and weiknesses. Jimezez Corporation: Forecasted Balance Sheet as of December 31, 2017 Jimenez Corporation: Forecasted income Statement for 2017 5. Urifte the ditta far the Jimenez Camoration kiven calculste the fotlowing: Industry a) Deys alles outntanding (365 ding year) b) Total Asser Tumover c) Profir Margin d) Return on Equity In a DuPont analysis sense - what does Lozano need to do to improve their Return on Equity relative to the industry average? ( 15 pts) 5. Using the data for the Jimenez Corporation given, calculate the following: Jimenez Industry a) Days sales outstanding ( 365 days year) b) Total Asset Turnover c) Profit Margin d) Return on Equity In a DuPont analysis sense - what does Lozano need to do to improve their Return on Equity relative to the industry average? ( 15pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts