Question: 5 Week 2 R Tn Practice C Sign In or X M Your ques X Chegg Stix C Search Al + E/attempt.php?attempt=81070198cmid=3347856&page=21&scrollpos=105.19999694824219#q22 * M InsideSherpa

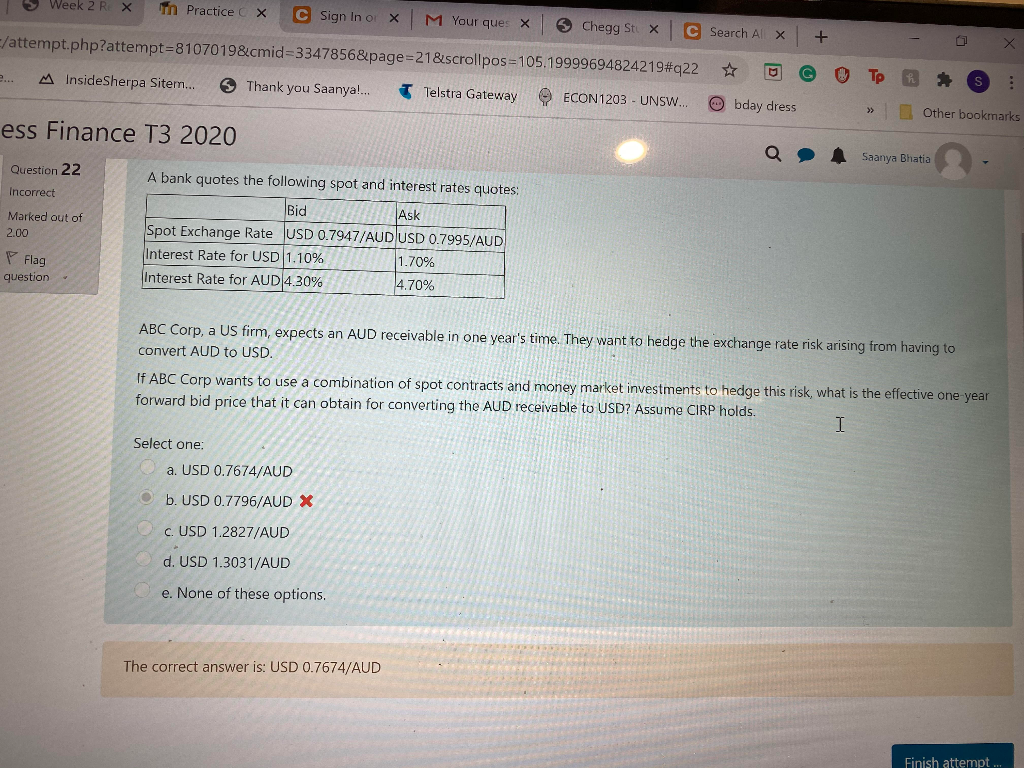

5 Week 2 R Tn Practice C Sign In or X M Your ques X Chegg Stix C Search Al + E/attempt.php?attempt=81070198cmid=3347856&page=21&scrollpos=105.19999694824219#q22 * M InsideSherpa Sitem... Thank you Saanya.... : Telstra Gateway ECON 1203 - UNSW.. bday dress Other bookmarks ess Finance T3 2020 Saanya Bhatia Question 22 Incorrect Marked out of 2.00 A bank quotes the following spot and interest rates quotes: Bid Ask Spot Exchange Rate USD 0.7947/AUD USD 0.7995/AUD Interest Rate for USD 1.10% 1.70% Interest Rate for AUD 4.30% 4.70% Flag question ABC Corp, a US firm, expects an AUD receivable in one year's time. They want to hedge the exchange rate risk arising from having to convert AUD to USD. If ABC Corp wants to use a combination of spot contracts and money market investments to hedge this risk, what is the effective one year forward bid price that it can obtain for converting the AUD receivable to USD? Assume CIRP holds. I Select one: a. USD 0.7674/AUD b. USD 0.7796/AUD X c. USD 1.2827/AUD d. USD 1.3031/AUD e. None of these options, The correct answer is: USD 0.7674/AUD Finish attempt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts