Question: 5. What is hyperinflation? Hyperinflation is frequently caused when a government monetizes its debt. Explain. Use the quantity theory of money to show how this

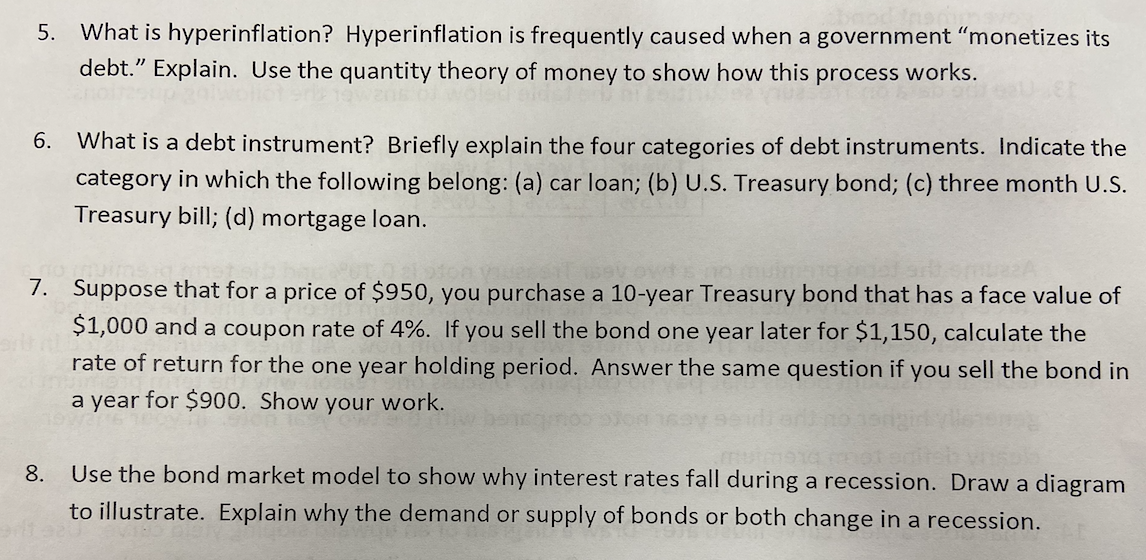

5. What is hyperinflation? Hyperinflation is frequently caused when a government "monetizes its debt. Explain. Use the quantity theory of money to show how this process works. 6. What is a debt instrument? Briefly explain the four categories of debt instruments. Indicate the category in which the following belong: (a) car loan; (b) U.S. Treasury bond; (c) three month U.S. Treasury bill; (d) mortgage loan. 7. Suppose that for a price of $950, you purchase a 10-year Treasury bond that has a face value of $1,000 and a coupon rate of 4%. If you sell the bond one year later for $1,150, calculate the rate of return for the one year holding period. Answer the same question if you sell the bond in a year for $900. Show your work. 8. Use the bond market model to show why interest rates fall during a recession. Draw a diagram to illustrate. Explain why the demand or supply of bonds or both change in a recession. 5. What is hyperinflation? Hyperinflation is frequently caused when a government "monetizes its debt. Explain. Use the quantity theory of money to show how this process works. 6. What is a debt instrument? Briefly explain the four categories of debt instruments. Indicate the category in which the following belong: (a) car loan; (b) U.S. Treasury bond; (c) three month U.S. Treasury bill; (d) mortgage loan. 7. Suppose that for a price of $950, you purchase a 10-year Treasury bond that has a face value of $1,000 and a coupon rate of 4%. If you sell the bond one year later for $1,150, calculate the rate of return for the one year holding period. Answer the same question if you sell the bond in a year for $900. Show your work. 8. Use the bond market model to show why interest rates fall during a recession. Draw a diagram to illustrate. Explain why the demand or supply of bonds or both change in a recession

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts