Question: 5, When evaluating a foreign investment project, it is important for the MNC to consider the effect of political risk, as a sovereign country can

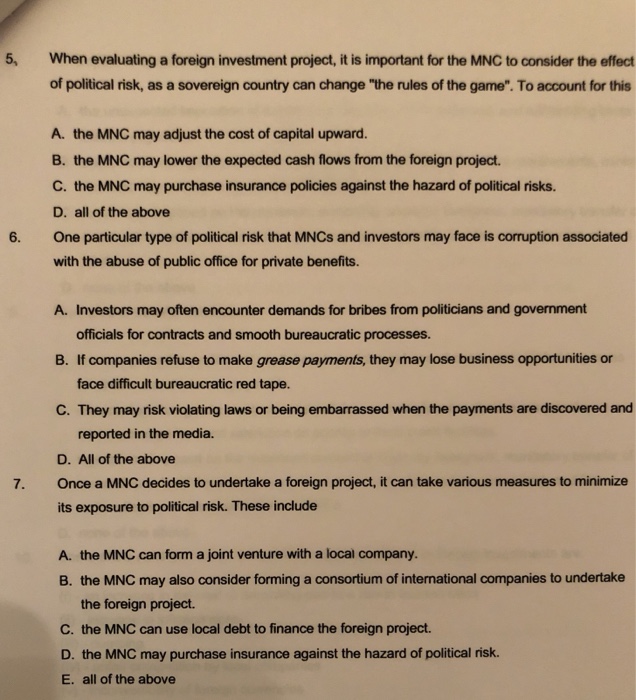

5, When evaluating a foreign investment project, it is important for the MNC to consider the effect of political risk, as a sovereign country can change "the rules of the game". To account for this A. the MNC may adjust the cost of capital upward. B. the MNC may lower the expected cash flows from the foreign project. C. the MNC may purchase insurance policies against the hazard of political risks. D. all of the above 6. One particular type of political risk that MNCs and investors may face is corruption associated with the abuse of public office for private benefits. A. Investors may often encounter demands for bribes from politicians and government officials for contracts and smooth bureaucratic processes. B. If companies refuse to make grease payments, they may lose business opportunities or face difficult bureaucratic red tape. C. They may risk violating laws or being embarrassed when the payments are discovered and reported in the media. D. All of the above 7. Once a MNC decides to undertake a foreign project, it can take various measures to minimize its exposure to political risk. These include A. the MNC can form a joint venture with a local company B. the MNC may also consider forming a consortium of international companies to undertake the foreign project. C. the MNC can use local debt to finance the foreign project. D. the MNC may purchase insurance against the hazard of political risk. E. all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts