Question: 5) Why does interest expense decrease during the life of an installment note payable? How is the amount of interest expense computed? 6) What is

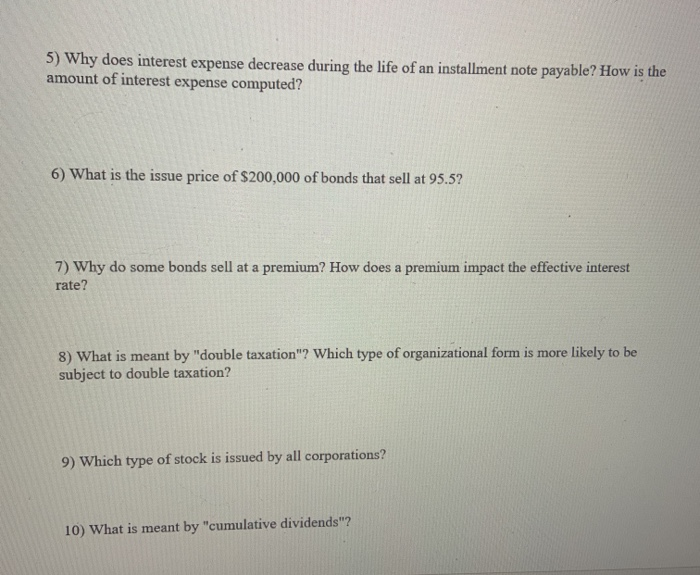

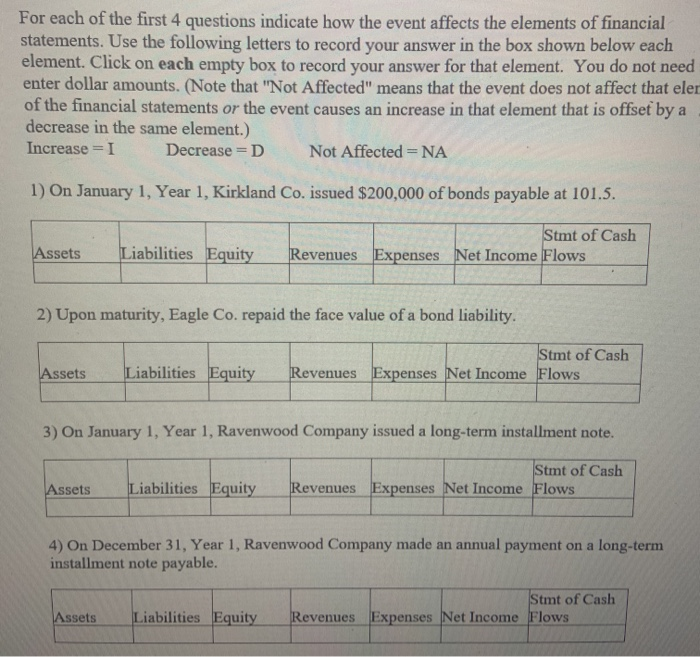

5) Why does interest expense decrease during the life of an installment note payable? How is the amount of interest expense computed? 6) What is the issue price of $200,000 of bonds that sell at 95.52 7) Why do some bonds sell at a premium? How does a premium impact the effective interest rate? 8) What is meant by "double taxation"? Which type of organizational form is more likely to be subject to double taxation? 9) Which type of stock is issued by all corporations? 10) What is meant by "cumulative dividends"? For each of the first 4 questions indicate how the event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. Click on each empty box to record your answer for that element. You do not need enter dollar amounts. (Note that "Not Affected" means that the event does not affect that eler of the financial statements or the event causes an increase in that element that is offset by a decrease in the same element.) Increase = I Decrease =D Not Affected = NA 1) On January 1, Year 1, Kirkland Co. issued $200,000 of bonds payable at 101.5. Stmt of Cash Revenues Expenses Net Income Flows Assets Liabilities Equity 2) Upon maturity, Eagle Co. repaid the face value of a bond liability. Assets Liabilities Equity Stmt of Cash Revenues Expenses Net Income Flows 3) On January 1, Year 1, Ravenwood Company issued a long-term installment note. Assets Liabilities Equity Stmt of Cash Revenues Expenses Net Income Flows 4) On December 31, Year 1, Ravenwood Company made an annual payment on a long-term installment note payable. Stmt of Cash Revenues Expenses Net Income Flows Assets Liabilities Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts