Question: 5 working day/week The assignment must be submitted as an Excel file. You can use different spreadsheets in the workbook to show your calculations 1.

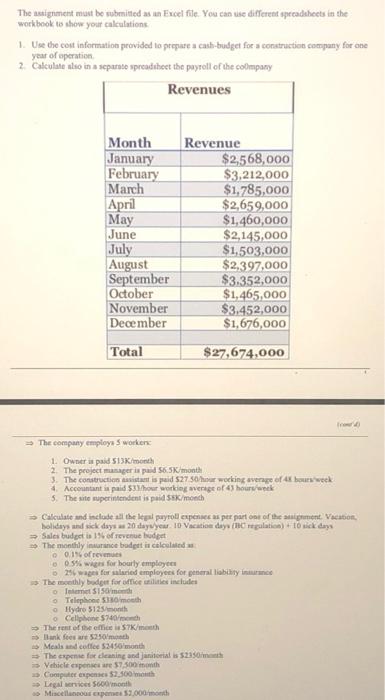

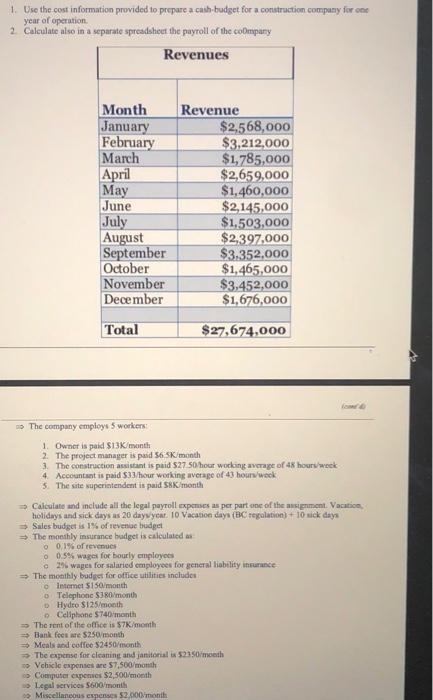

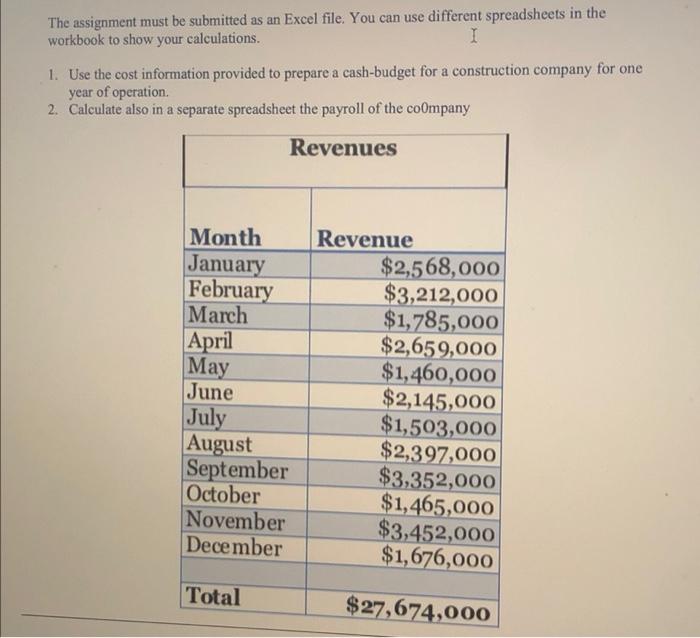

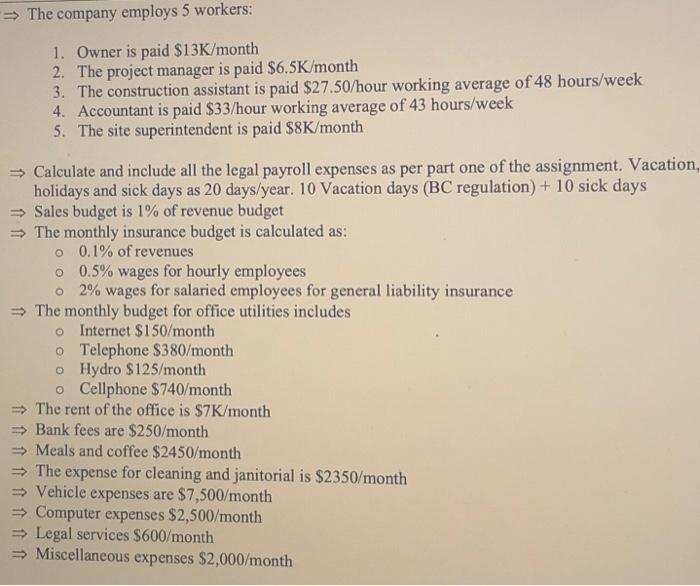

The assignment must be submitted as an Excel file. You can use different spreadsheets in the workbook to show your calculations 1. Use the cost information provided to prepare a cash-budget for a construction company for one year of operation 2. Calculate also in a separate spreadsheet the payroll of the company Revenues Month Revenue January February $2,568,000 $3,212,000 March $1,785,000 April $2,659,000 $1,460,000 June $2,145,000 July $1,503,000 $2,397,000 August September $3.352,000 October $1,465,000 November $3.452,000 December $1,676,000 Total $27,674,000 (ro) The company employs 5 workers 1. Owner is paid $13K/month 2. The project manager is paid $6.5K/month 3. The construction assistant is paid $27.50/hour working average of 48 hours week 4. Accountant is paid $33/hour working average of 43 hours/week 5. The site superintendent is paid SSK/month Calculate and include all the legal payroll expenses as per part one of the assignment Vacation, holidays and sick days as 20 days/year. 10 Vacation days (BC regulation) + 10 sick days Sales budget is 1% of revenue budget The monthly insurance budget is calculated as o 0.1% of revenues 0.5% wages for hourly employees o 2% wages for salaried employees for general liability insurance The monthly budget for office utilities includes o Internet $150 Telephone $180/month o Hydro 5125/month o Cellphone $740/month The rest of the office is $7K/moth Bank fees are $250/month Meals and coffee $2450/month The expense for cleaning and janitorial is $2350/month i Vehicle expenses are $7,500 month Computer expenses $2,500 month Legal services $600/month Miscellaneous expenses $2,000/month May 1. Use the cost information provided to prepare a cash-budget for a construction company for one year of operation. 2. Calculate also in a separate spreadsheet the payroll of the company Revenues Month January $2,568,000 February $3,212,000 March $1,785,000 April $2,659,000 May $1,460,000 June $2,145,000 $1,503,000 July August September $2,397,000 $3.352,000 October $1,465,000 November $3,452,000 December $1,676,000 Total $27,674,000 & The company employs 5 workers: 1. Owner is paid $13K/month 2. The project manager is paid $6.5K/month 3. The construction assistant is paid $27.50/hour working average of 48 hours/week 4. Accountant is paid $33/hour working average of 43 hours/week 5. The site superintendent is paid $8K/month Calculate and include all the legal payroll expenses as per part one of the assignment. Vacation, holidays and sick days as 20 days/year. 10 Vacation days (BC regulation) + 10 sick days Sales budget is 1% of revenue budget The monthly insurance budget is calculated as o 0.1% of revenues o 0.5% wages for bourly employees o 2% wages for salaried employees for general liability insurance The monthly budget for office utilities includes o Internet $150/month o Telephone $380/month o Hydro $125/month o Cellphone $740/month The rent of the office is $7K/month Bank fees are $250/month Meals and coffee $2450/month The expense for cleaning and janitorial is $2350/month Vehicle expenses are $7,500/month Computer expenses $2,500/month Legal services $600/month Miscellaneous expenses $2,000/month Revenue The assignment must be submitted as an Excel file. You can use different spreadsheets in the workbook to show your calculations. I 1. Use the cost information provided to prepare a cash-budget for a construction company for one year of operation. 2. Calculate also in a separate spreadsheet the payroll of the company Revenues Month January $2,568,000 February $3,212,000 March $1,785,000 April $2,659,000 May $1,460,000 June $2,145,000 July $1,503,000 $2,397,000 August September $3,352,000 October $1,465,000 November $3,452,000 December $1,676,000 Total $27,674,000 Revenue The company employs 5 workers: 1. Owner is paid $13K/month 2. The project manager is paid $6.5K/month 3. The construction assistant is paid $27.50/hour working average of 48 hours/week 4. Accountant is paid $33/hour working average of 43 hours/week 5. The site superintendent is paid $8K/month Calculate and include all the legal payroll expenses as per part one of the assignment. Vacation, holidays and sick days as 20 days/year. 10 Vacation days (BC regulation) + 10 sick days Sales budget is 1% of revenue budget The monthly insurance budget is calculated as: o 0.1% of revenues o 0.5% wages for hourly employees o 2% wages for salaried employees for general liability insurance. The monthly budget for office utilities includes o Internet $150/month o Telephone $380/month o Hydro $125/month o Cellphone $740/month The rent of the office is $7K/month Bank fees are $250/month Meals and coffee $2450/month The expense for cleaning and janitorial is $2350/month Vehicle expenses are $7,500/month Computer expenses $2,500/month Legal services $600/month Miscellaneous expenses $2,000/month The assignment must be submitted as an Excel file. You can use different spreadsheets in the workbook to show your calculations 1. Use the cost information provided to prepare a cash-budget for a construction company for one year of operation 2. Calculate also in a separate spreadsheet the payroll of the company Revenues Month Revenue January February $2,568,000 $3,212,000 March $1,785,000 April $2,659,000 $1,460,000 June $2,145,000 July $1,503,000 $2,397,000 August September $3.352,000 October $1,465,000 November $3.452,000 December $1,676,000 Total $27,674,000 (ro) The company employs 5 workers 1. Owner is paid $13K/month 2. The project manager is paid $6.5K/month 3. The construction assistant is paid $27.50/hour working average of 48 hours week 4. Accountant is paid $33/hour working average of 43 hours/week 5. The site superintendent is paid SSK/month Calculate and include all the legal payroll expenses as per part one of the assignment Vacation, holidays and sick days as 20 days/year. 10 Vacation days (BC regulation) + 10 sick days Sales budget is 1% of revenue budget The monthly insurance budget is calculated as o 0.1% of revenues 0.5% wages for hourly employees o 2% wages for salaried employees for general liability insurance The monthly budget for office utilities includes o Internet $150 Telephone $180/month o Hydro 5125/month o Cellphone $740/month The rest of the office is $7K/moth Bank fees are $250/month Meals and coffee $2450/month The expense for cleaning and janitorial is $2350/month i Vehicle expenses are $7,500 month Computer expenses $2,500 month Legal services $600/month Miscellaneous expenses $2,000/month May 1. Use the cost information provided to prepare a cash-budget for a construction company for one year of operation. 2. Calculate also in a separate spreadsheet the payroll of the company Revenues Month January $2,568,000 February $3,212,000 March $1,785,000 April $2,659,000 May $1,460,000 June $2,145,000 $1,503,000 July August September $2,397,000 $3.352,000 October $1,465,000 November $3,452,000 December $1,676,000 Total $27,674,000 & The company employs 5 workers: 1. Owner is paid $13K/month 2. The project manager is paid $6.5K/month 3. The construction assistant is paid $27.50/hour working average of 48 hours/week 4. Accountant is paid $33/hour working average of 43 hours/week 5. The site superintendent is paid $8K/month Calculate and include all the legal payroll expenses as per part one of the assignment. Vacation, holidays and sick days as 20 days/year. 10 Vacation days (BC regulation) + 10 sick days Sales budget is 1% of revenue budget The monthly insurance budget is calculated as o 0.1% of revenues o 0.5% wages for bourly employees o 2% wages for salaried employees for general liability insurance The monthly budget for office utilities includes o Internet $150/month o Telephone $380/month o Hydro $125/month o Cellphone $740/month The rent of the office is $7K/month Bank fees are $250/month Meals and coffee $2450/month The expense for cleaning and janitorial is $2350/month Vehicle expenses are $7,500/month Computer expenses $2,500/month Legal services $600/month Miscellaneous expenses $2,000/month Revenue The assignment must be submitted as an Excel file. You can use different spreadsheets in the workbook to show your calculations. I 1. Use the cost information provided to prepare a cash-budget for a construction company for one year of operation. 2. Calculate also in a separate spreadsheet the payroll of the company Revenues Month January $2,568,000 February $3,212,000 March $1,785,000 April $2,659,000 May $1,460,000 June $2,145,000 July $1,503,000 $2,397,000 August September $3,352,000 October $1,465,000 November $3,452,000 December $1,676,000 Total $27,674,000 Revenue The company employs 5 workers: 1. Owner is paid $13K/month 2. The project manager is paid $6.5K/month 3. The construction assistant is paid $27.50/hour working average of 48 hours/week 4. Accountant is paid $33/hour working average of 43 hours/week 5. The site superintendent is paid $8K/month Calculate and include all the legal payroll expenses as per part one of the assignment. Vacation, holidays and sick days as 20 days/year. 10 Vacation days (BC regulation) + 10 sick days Sales budget is 1% of revenue budget The monthly insurance budget is calculated as: o 0.1% of revenues o 0.5% wages for hourly employees o 2% wages for salaried employees for general liability insurance. The monthly budget for office utilities includes o Internet $150/month o Telephone $380/month o Hydro $125/month o Cellphone $740/month The rent of the office is $7K/month Bank fees are $250/month Meals and coffee $2450/month The expense for cleaning and janitorial is $2350/month Vehicle expenses are $7,500/month Computer expenses $2,500/month Legal services $600/month Miscellaneous expenses $2,000/month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts