Question: 5. Year (25 points) You are evaluating a stock for possible investment. You have determined the following regarding the expected performance of the stock

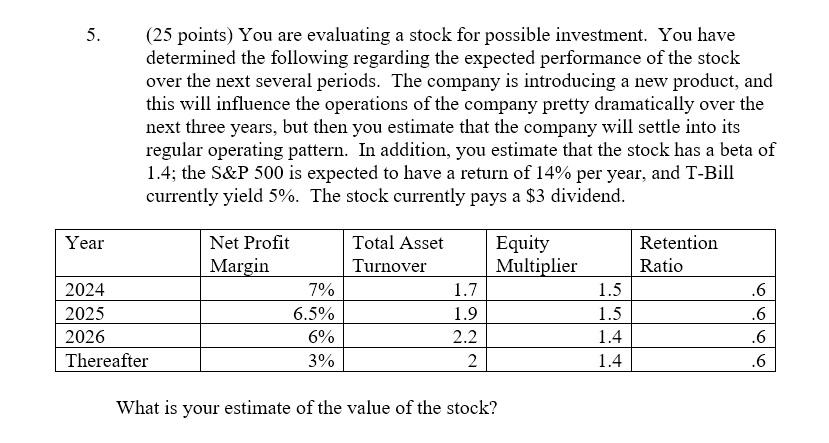

5. Year (25 points) You are evaluating a stock for possible investment. You have determined the following regarding the expected performance of the stock over the next several periods. The company is introducing a new product, and this will influence the operations of the company pretty dramatically over the next three years, but then you estimate that the company will settle into its regular operating pattern. In addition, you estimate that the stock has a beta of 1.4; the S&P 500 is expected to have a return of 14% per year, and T-Bill currently yield 5%. The stock currently pays a $3 dividend. 2024 2025 2026 Thereafter Net Profit Margin 7% 6.5% 6% 3% Total Asset Turnover 1.7 1.9 2.2 2 Equity Multiplier What is your estimate of the value of the stock? 1.5 1.5 1.4 1.4 Retention Ratio .6 .6 .6 .6

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

To estimate the value of the stock we can use the dividend discount model DDM and the Capital Asset ... View full answer

Get step-by-step solutions from verified subject matter experts