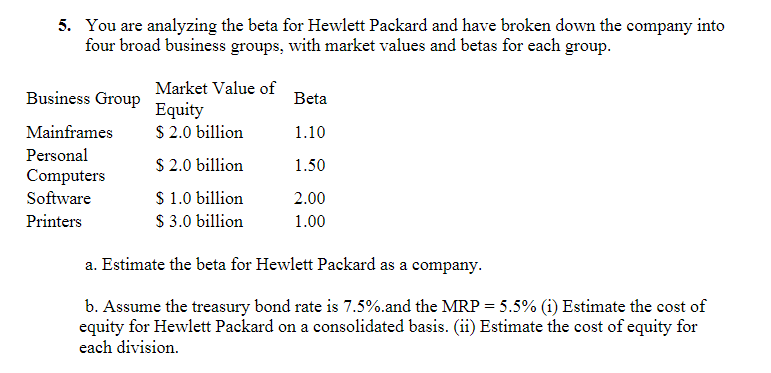

Question: 5. You are analyzing the beta for Hewlett Packard and have broken down the company into four broad business groups, with market values and betas

5. You are analyzing the beta for Hewlett Packard and have broken down the company into four broad business groups, with market values and betas for each group. Beta Business Group Mainframes Personal Computers Software Printers Market Value of Equity $ 2.0 billion $ 2.0 billion 1.10 1.50 $ 1.0 billion $ 3.0 billion 2.00 1.00 a. Estimate the beta for Hewlett Packard as a company. b. Assume the treasury bond rate is 7.5%.and the MRP = 5.5% (1) Estimate the cost of equity for Hewlett Packard on a consolidated basis. (ii) Estimate the cost of equity for each division

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock