Question: 5. You have a portfolio which has an average return of 13.8 percent. In any given year, you have a 5.0 percent probability of earning

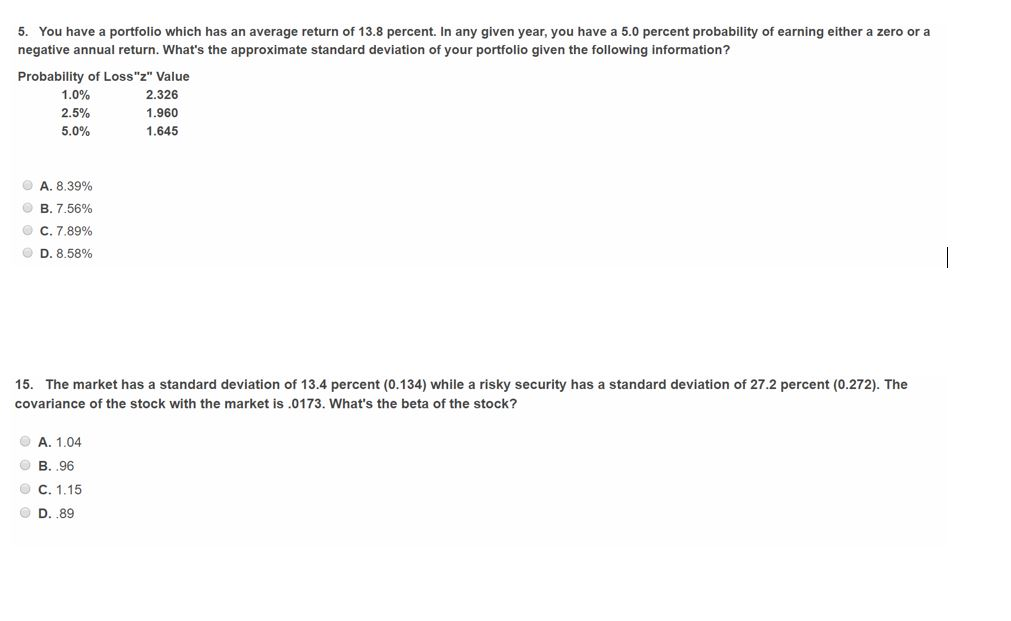

5. You have a portfolio which has an average return of 13.8 percent. In any given year, you have a 5.0 percent probability of earning either a zero or a negative annual return. What's the approximate standard deviation of your portfolio given the following information? Probability of Loss"z" Value 1.0% 2.326 2.5% 1.960 5.0% 1.645 A. 8.39% B. 7.56% C. 7.89% D. 8.58% 15. The market has a standard deviation of 13.4 percent (0.134) while a risky security has a standard deviation of 27.2 percent (0.272). The covariance of the stock with the market is .0173. What's the beta of the stock? A. 1.04 B..96 C. 1.15 D..89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts