Question: 5. Your firm is considering leasing a machine that will be used in the production process. The lease with a term of 4 years calls

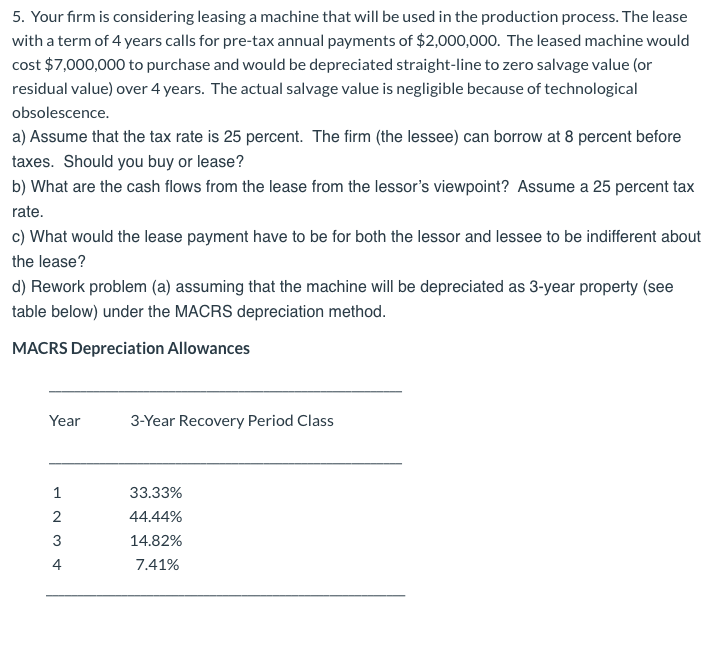

5. Your firm is considering leasing a machine that will be used in the production process. The lease with a term of 4 years calls for pre-tax annual payments of $2,000,000. The leased machine would cost $7,000,000 to purchase and would be depreciated straight-line to zero salvage value (or residual value) over 4 years. The actual salvage value is negligible because of technological obsolescence. a) Assume that the tax rate is 25 percent. The firm (the lessee) can borrow at 8 percent before taxes. Should you buy or lease? b) What are the cash flows from the lease from the lessor's viewpoint? Assume a 25 percent tax rate. c) What would the lease payment have to be for both the lessor and lessee to be indifferent about the lease? d) Rework problem (a) assuming that the machine will be depreciated as 3-year property (see table below) under the MACRS depreciation method. MACRS Depreciation Allowances Year 3-Year Recovery Period Class 33.33% 44.44% 14.82% 7.41% +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts