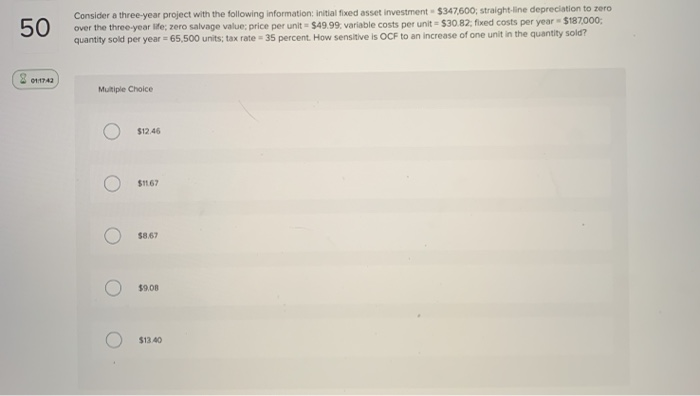

Question: 50 Consider a three-year project with the following information initial fixed asset investment - $347.600, straight-line depreciation to zero over the three-year life; zero salvage

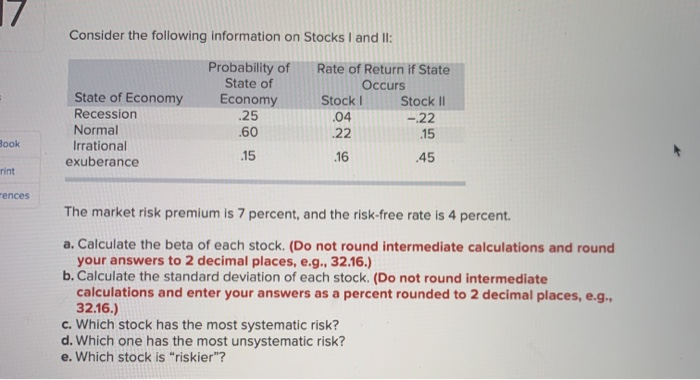

50 Consider a three-year project with the following information initial fixed asset investment - $347.600, straight-line depreciation to zero over the three-year life; zero salvage value price per unit - $49.99, variable costs per unit - $30.82 fixed costs per year $187,000; quantity sold per year 65,500 units tax rate = 35 percent. How sensitive is OCF to an increase of one unit in the quantity sold? 943 Multiple Choice $12.46 $1167 58.67 $9.00 $13.40 Consider the following information on Stocks I and II: State of Economy Recession Normal Irrational exuberance Probability of State of Economy .25 .60 .15 Rate of Return if State Occurs Stock I Stock Il .04 -22 .15 .16 .45 .22 Book rint rences The market risk premium is 7 percent, and the risk-free rate is 4 percent. a. Calculate the beta of each stock. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation of each stock. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. Which stock has the most systematic risk? d. Which one has the most unsystematic risk? e. Which stock is "riskier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts