Question: 50 Exercises in Compound Interest Study the appendix. Then answer the following questions: 1. At age 60, you find that your employer is moving to

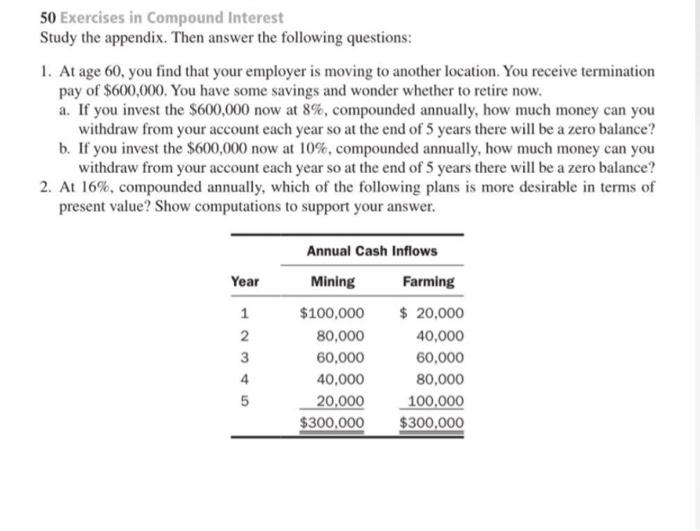

50 Exercises in Compound Interest Study the appendix. Then answer the following questions: 1. At age 60, you find that your employer is moving to another location. You receive termination pay of $600,000. You have some savings and wonder whether to retire now. a. If you invest the $600,000 now at 8%, compounded annually, how much money can you withdraw from your account each year so at the end of 5 years there will be a zero balance? b. If you invest the $600,000 now at 10%, compounded annually, how much money can you withdraw from your account each year so at the end of 5 years there will be a zero balance? 2. At 16%, compounded annually, which of the following plans is more desirable in terms of present value? Show computations to support your answer. Year 1 2 3 4 5 Annual Cash Inflows Mining Farming $100,000 $ 20,000 80,000 40,000 60,000 60,000 40,000 80,000 20,000 100,000 $300,000 $300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts