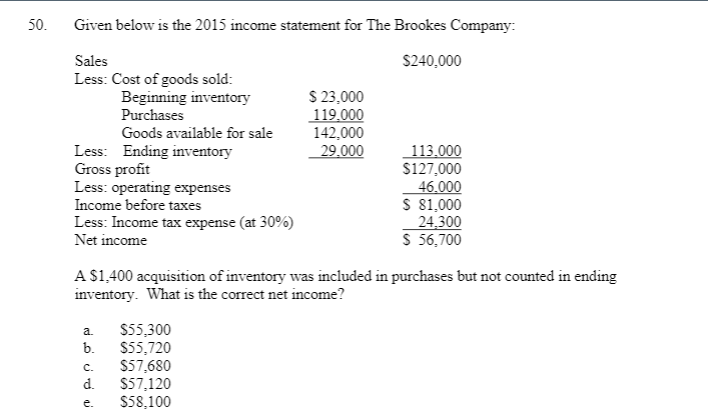

Question: 50. Given below is the 2015 income statement for The Brookes Company: $240,000 Sales Less: Cost of goods sold: Beginning inventory Purchases Goods available for

50. Given below is the 2015 income statement for The Brookes Company: $240,000 Sales Less: Cost of goods sold: Beginning inventory Purchases Goods available for sale Less: Ending inventory Gross profit Less: operating expenses Income before taxes Less: Income tax expense (at 30%) Net income $ 23,000 119.000 142.000 29.000 113.000 $127.000 46,000 $ 81,000 24.300 $ 56,700 A $1,400 acquisition of inventory was included in purchases but not counted in ending inventory. What is the correct net income? a. b. c. $55,300 $55,720 $57,680 $57,120 $58.100 d. e

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock