Question: 50. The gain on early retirement of bonds on December 31, 2021* For items 49 and 50 On January 1, 2020, Sincerity Company issued 5,000

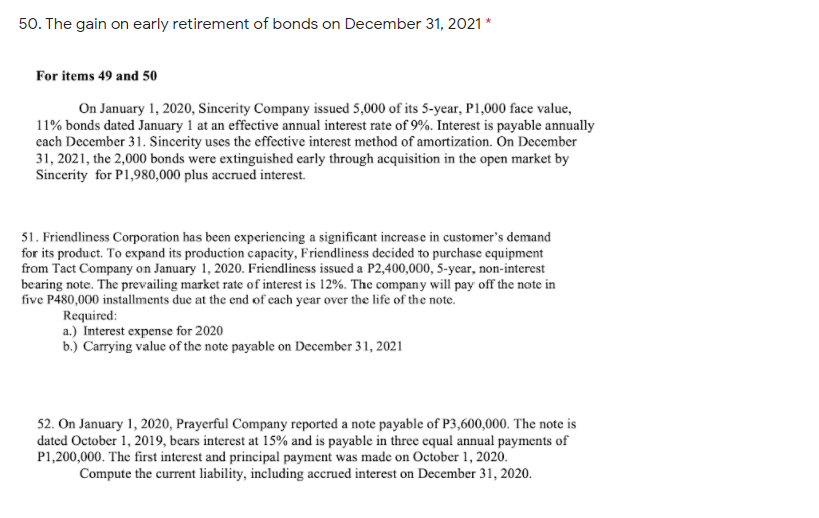

50. The gain on early retirement of bonds on December 31, 2021* For items 49 and 50 On January 1, 2020, Sincerity Company issued 5,000 of its 5-year, P1,000 face value, 11% bonds dated January 1 at an effective annual interest rate of 9%. Interest is payable annually cach December 31. Sincerity uses the effective interest method of amortization. On December 31, 2021, the 2,000 bonds were extinguished early through acquisition in the open market by Sincerity for P1,980,000 plus accrued interest. 51. Friendliness Corporation has been experiencing a significant increase in customer's demand for its product. To expand its production capacity, Friendliness decided to purchase equipment from Tact Company on January 1, 2020. Friendliness issued a P2,400,000, 5-year, non-interest bearing note. The prevailing market rate of interest is 12%. The company will pay off the note in five P480,000 installments due at the end of each year over the life of the note. Required: a.) Interest expense for 2020 b.) Carrying value of the note payable on December 31, 2021 52. On January 1, 2020, Prayerful Company reported a note payable of P3,600,000. The note is dated October 1, 2019, bears interest at 15% and is payable in three equal annual payments of P1,200,000. The first interest and principal payment was made on October 1, 2020. Compute the current liability, including accrued interest on December 31, 2020. 50. The gain on early retirement of bonds on December 31, 2021* For items 49 and 50 On January 1, 2020, Sincerity Company issued 5,000 of its 5-year, P1,000 face value, 11% bonds dated January 1 at an effective annual interest rate of 9%. Interest is payable annually cach December 31. Sincerity uses the effective interest method of amortization. On December 31, 2021, the 2,000 bonds were extinguished early through acquisition in the open market by Sincerity for P1,980,000 plus accrued interest. 51. Friendliness Corporation has been experiencing a significant increase in customer's demand for its product. To expand its production capacity, Friendliness decided to purchase equipment from Tact Company on January 1, 2020. Friendliness issued a P2,400,000, 5-year, non-interest bearing note. The prevailing market rate of interest is 12%. The company will pay off the note in five P480,000 installments due at the end of each year over the life of the note. Required: a.) Interest expense for 2020 b.) Carrying value of the note payable on December 31, 2021 52. On January 1, 2020, Prayerful Company reported a note payable of P3,600,000. The note is dated October 1, 2019, bears interest at 15% and is payable in three equal annual payments of P1,200,000. The first interest and principal payment was made on October 1, 2020. Compute the current liability, including accrued interest on December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts