Question: 50,250 , 42,713 , 53,250 , 45,263 are all wrong answers. Required Information Exercise 11-4 (Algo) Other depreciation methods [LO11-2] [The following information applies to

50,250 , 42,713 , 53,250 , 45,263 are all wrong answers.

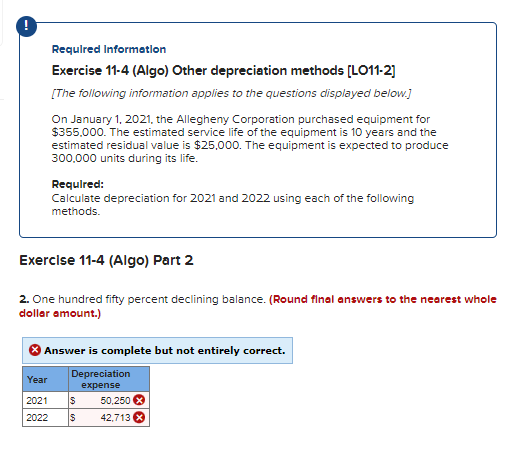

Required Information Exercise 11-4 (Algo) Other depreciation methods [LO11-2] [The following information applies to the questions displayed below.] On January 1, 2021, the Allegheny Corporation purchased equipment for $355.000. The estimated service life of the equipment is 10 years and the estimated residual value is $25,000. The equipment is expected to produce 300.000 units during its life. Required: Calculate depreciation for 2021 and 2022 using each of the following methods. Exercise 11-4 (Algo) Part 2 2. One hundred fifty percent declining balance. (Round final answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. Year Depreciation expense 2021 $ 50,250 X 2022 $ 42,713 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts