Question: 5.1 BSA, a company specialized in high frequency algorithm trading, wants to purchase a new advanced trading infraestructure with powerful computers. Listed below is the

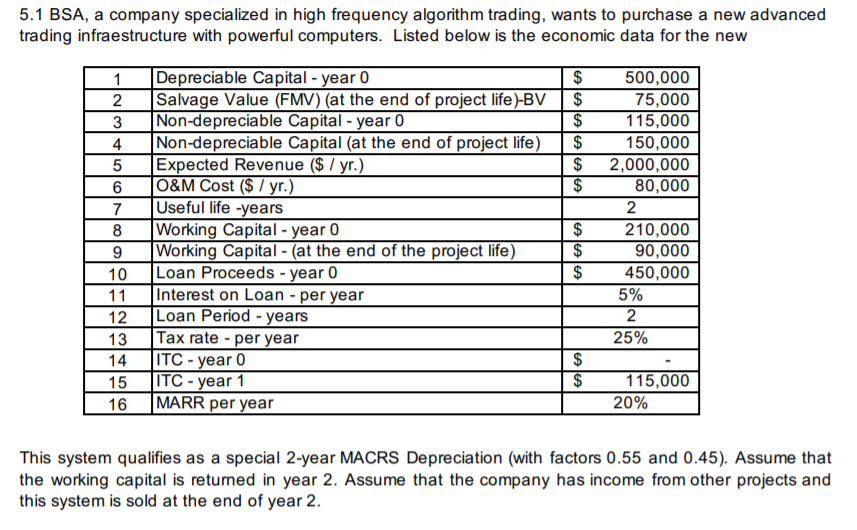

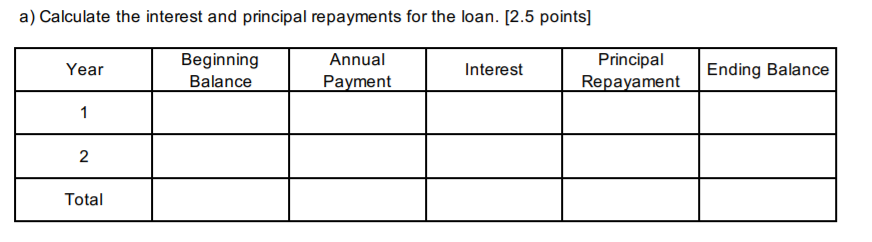

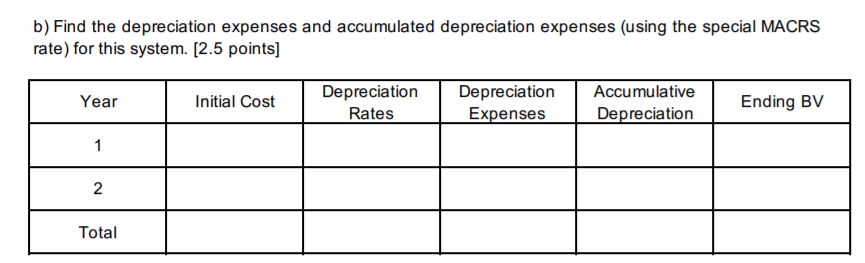

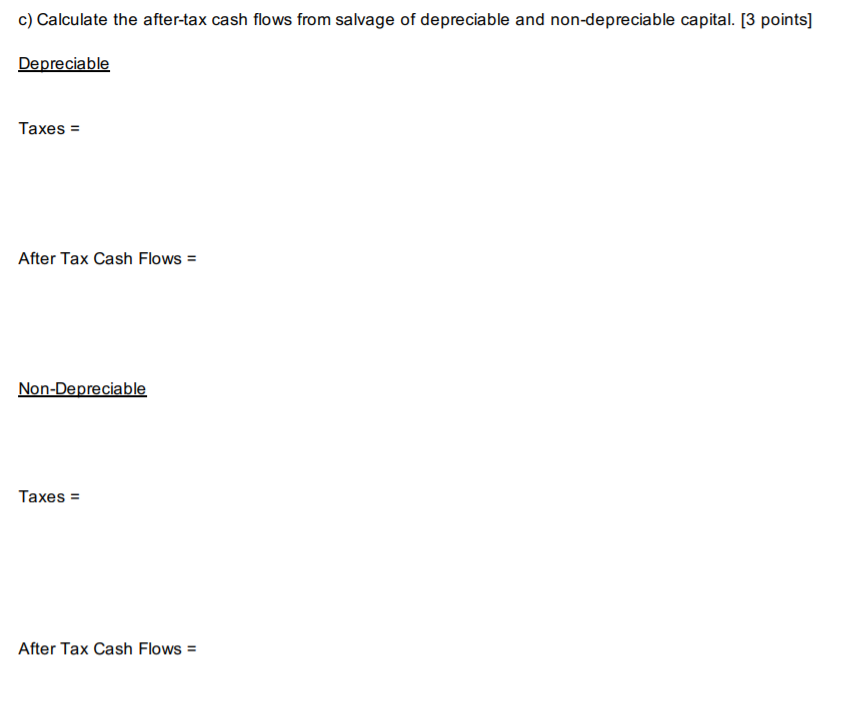

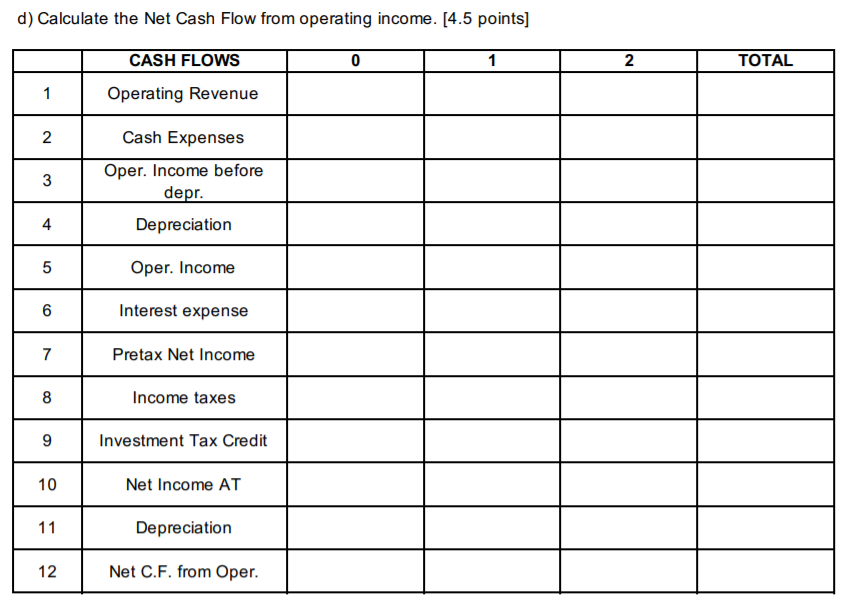

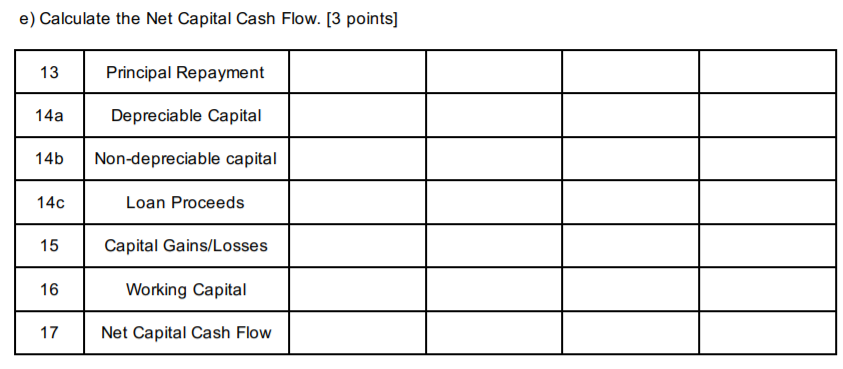

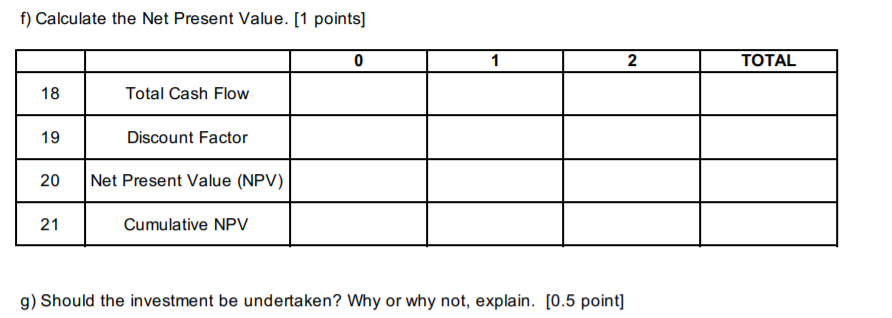

5.1 BSA, a company specialized in high frequency algorithm trading, wants to purchase a new advanced trading infraestructure with powerful computers. Listed below is the economic data for the new 1 Depreciable Capital - year 0 500,000 75,000 115,000 2 Salvage Value (FMV) (at the end of project life)BV $ 3 Non-depreciable Capital-year 0 4 Non-depreciable Capital (at the end of project life 150,000 5 Expected Revenue (/ yr.) 6 0&M Cost (S yr. 7 Useful life -years $ 2,000,000 80,000 8 Working Capital - year 0 210,000 9Working Capital (at the end of the project life) 10 Loan Proceeds -year 0 11 Interest on Loan - per year 12 Loan Period - years 13 Tax rate per year 14 ITC-year 0 15 ITC year 1 16 MARR per year $ 450,000 5% 2 25% 20% This system qualifies as a special 2-year MACRS Depreciation (with factors 0.55 and 0.45). Assume that the working capital is returned in year 2. Assume that the company has income from other projects and this system is sold at the end of year 2 a) Calculate the interest and principal repayments for the loan. [2.5 points] Principal Beginning Balance Annual Year Interest Ending Balance 2 Total b) Find the depreciation expenses and accumulated depreciation expenses (using the special MACRS rate) for this system. [2.5 points] Depreciation Depreciation Accumulative Year Initial Cost Ending BV Rates 2 Total c) Calculate the after-tax cash flows from salvage ofd le and non-depreciable capital. 13 points] Taxes = After Tax Cash Flows Taxes- After Tax Cash Flows = d) Calculate the Net Cash Flow from operating income. [4.5 points] CASH FLOWS Operating Revenue Cash Expenses Oper. Income before 2 TOTAL 2 depr Depreciation Oper. Income Interest expense Pretax Net Income Income taxes 4 6 9 Investment Tax Credit 10 Net Income AT Depreciation Net C.F. from Oper 12 e) Calculate the Net Capital Cash Flow. [3 points] 13 Principal Repayment 14a Depreciable Capital 14b Non-depreciable capital 14C 15 Capital Gains/Losses 16 17 Net Capital Cash Flow Loan Proceeds Working Capital 5.1 BSA, a company specialized in high frequency algorithm trading, wants to purchase a new advanced trading infraestructure with powerful computers. Listed below is the economic data for the new 1 Depreciable Capital - year 0 500,000 75,000 115,000 2 Salvage Value (FMV) (at the end of project life)BV $ 3 Non-depreciable Capital-year 0 4 Non-depreciable Capital (at the end of project life 150,000 5 Expected Revenue (/ yr.) 6 0&M Cost (S yr. 7 Useful life -years $ 2,000,000 80,000 8 Working Capital - year 0 210,000 9Working Capital (at the end of the project life) 10 Loan Proceeds -year 0 11 Interest on Loan - per year 12 Loan Period - years 13 Tax rate per year 14 ITC-year 0 15 ITC year 1 16 MARR per year $ 450,000 5% 2 25% 20% This system qualifies as a special 2-year MACRS Depreciation (with factors 0.55 and 0.45). Assume that the working capital is returned in year 2. Assume that the company has income from other projects and this system is sold at the end of year 2 a) Calculate the interest and principal repayments for the loan. [2.5 points] Principal Beginning Balance Annual Year Interest Ending Balance 2 Total b) Find the depreciation expenses and accumulated depreciation expenses (using the special MACRS rate) for this system. [2.5 points] Depreciation Depreciation Accumulative Year Initial Cost Ending BV Rates 2 Total c) Calculate the after-tax cash flows from salvage ofd le and non-depreciable capital. 13 points] Taxes = After Tax Cash Flows Taxes- After Tax Cash Flows = d) Calculate the Net Cash Flow from operating income. [4.5 points] CASH FLOWS Operating Revenue Cash Expenses Oper. Income before 2 TOTAL 2 depr Depreciation Oper. Income Interest expense Pretax Net Income Income taxes 4 6 9 Investment Tax Credit 10 Net Income AT Depreciation Net C.F. from Oper 12 e) Calculate the Net Capital Cash Flow. [3 points] 13 Principal Repayment 14a Depreciable Capital 14b Non-depreciable capital 14C 15 Capital Gains/Losses 16 17 Net Capital Cash Flow Loan Proceeds Working Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts