Question: 5.1. Identify 5 differences between a Finance Lease and an Operating Lease? (10 marks) 5.2. MNO Ltd leases an asset as a lessee. The lease

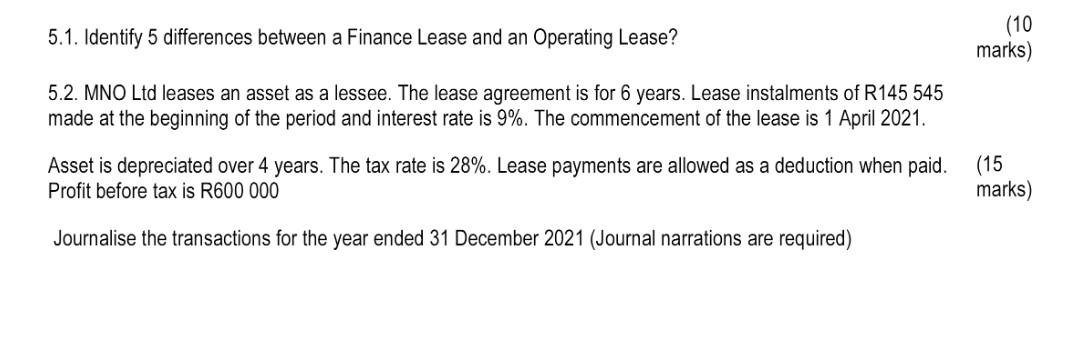

5.1. Identify 5 differences between a Finance Lease and an Operating Lease? (10 marks) 5.2. MNO Ltd leases an asset as a lessee. The lease agreement is for 6 years. Lease instalments of R145 545 made at the beginning of the period and interest rate is 9%. The commencement of the lease is 1 April 2021. Asset is depreciated over 4 years. The tax rate is 28%. Lease payments are allowed as a deduction when paid. (15 Profit before tax is R600 000 marks) Journalise the transactions for the year ended 31 December 2021 (Journal narrations are required)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts