Question: 51% Mon 6:30 PM ory Bookmarks Profiles Tab Window Help McGraw Ht Connect M Connect Sign in McGraw H Cycle. Class In 30 minutes 13909

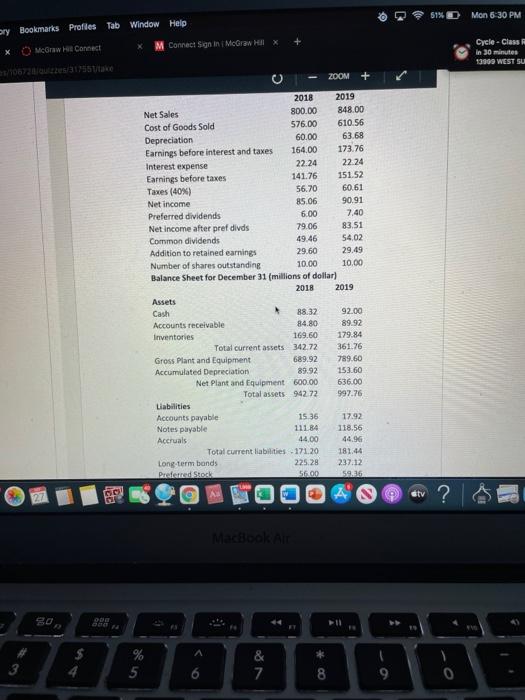

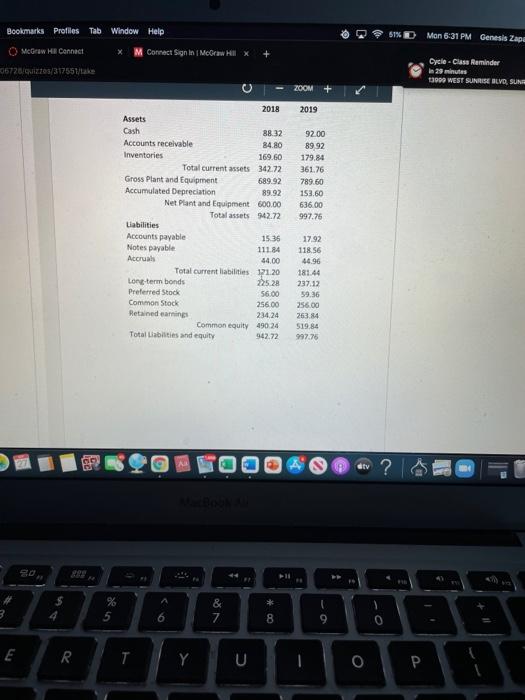

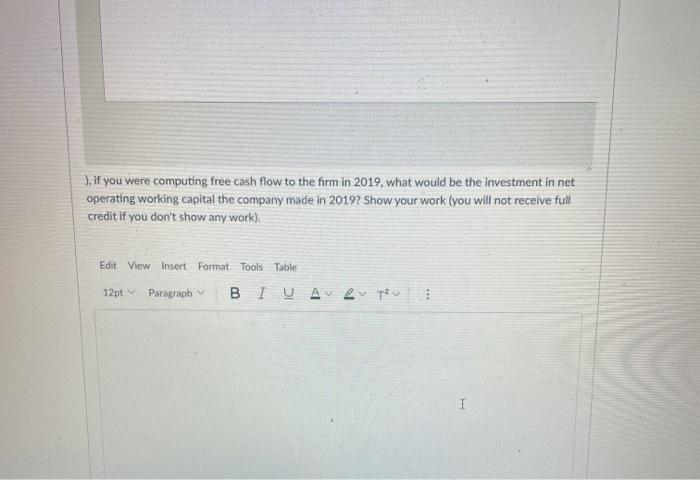

51% Mon 6:30 PM ory Bookmarks Profiles Tab Window Help McGraw Ht Connect M Connect Sign in McGraw H Cycle. Class In 30 minutes 13909 WEST SUN 1/1067231735take 200M + 2018 2019 Net Sales 800.00 848 00 Cost of Goods Sold 576.00 610 56 Depreciation 60.00 6368 Earnings before interest and taxes 164.00 173.76 Interest expense 22.24 22 24 Earnings before taxes 141.76 151.52 Taxes (40%) 56.70 60.61 Net income 85.06 90.91 Preferred dividends 6.00 7.40 Net Income after pref divds 79.06 83.51 Common dividends 49.46 54.02 Addition to retained earnings 29.60 29.49 Number of shares outstanding 10.00 10.00 Balance Sheet for December 31 millions of dollar) 2018 2019 Assets Cash 88.32 92.00 Accounts receivable 84.80 89.92 Inventories 169.60 179.84 Total current assets 342.72 361.76 Gross Plant and Equipment 689.92 789.60 Accumulated Depreciation 89.92 153.60 Net Plant and Equipment 600.00 636.00 Total assets 94272 997.76 Liabilities Accounts payable 15 36 17.92 Notes payable 111.84 118.56 Accruals 44,00 44.96 Total current liabilities - 171.20 181.44 Long-term bands 225.28 237.12 Padmed Stock 5600 5936 ? MacBook Air 3 4 % 5 6 & 7 8 9 0 Bookmarks Profiles Tab Window Help 51% Mon 6:31 PM Genesis Zape McGraw HR Connect x M Connect Sign in [McGraw Hill X + 0672/317557Lake Cicle-Class Reminder In 29 minutes 3 WEST SUNRISE EVO, SUN 200M + 2019 92.00 89 92 179.84 361.76 789.60 153,60 636.00 997.75 2018 Assets Cash 88.32 Accounts receivable 84.80 Inventories 169.60 Total current assets 342.72 Gross Plant and Equipment 689.92 Accumulated Depreciation 89.92 Net Plant and Equipment 600.00 Total assets 92.72 Liabilities Accounts payable 15:36 Notes payable 111.84 Accruals 44.00 Total current liabilities 171.20 Long-term bonds 22528 Preferred Stock 56.00 Common Stock 25600 Retained earnings 234.24 Common equity 490.24 Total Liabilities and equity 942.72 17.92 118.56 44.96 181.44 23712 59.36 256.00 263 84 $19.84 997.76 ola > & % 5 * 00 6 N 9 E 70 T Y U O ), if you were computing free cash flow to the firm in 2019, what would be the investment in net operating working capital the company made in 2019? Show your work (you will not receive full credit if you don't show any work). Edit View Insert Format Tools Table 12pt Paragraph IVAvey

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts