Question: 5-14 please help... Lesson Practice Use the Single Persons Weekly Payroll and Married Persons Weekly Payroll tables on pages A2-A5 to find the federal income

5-14 please help...

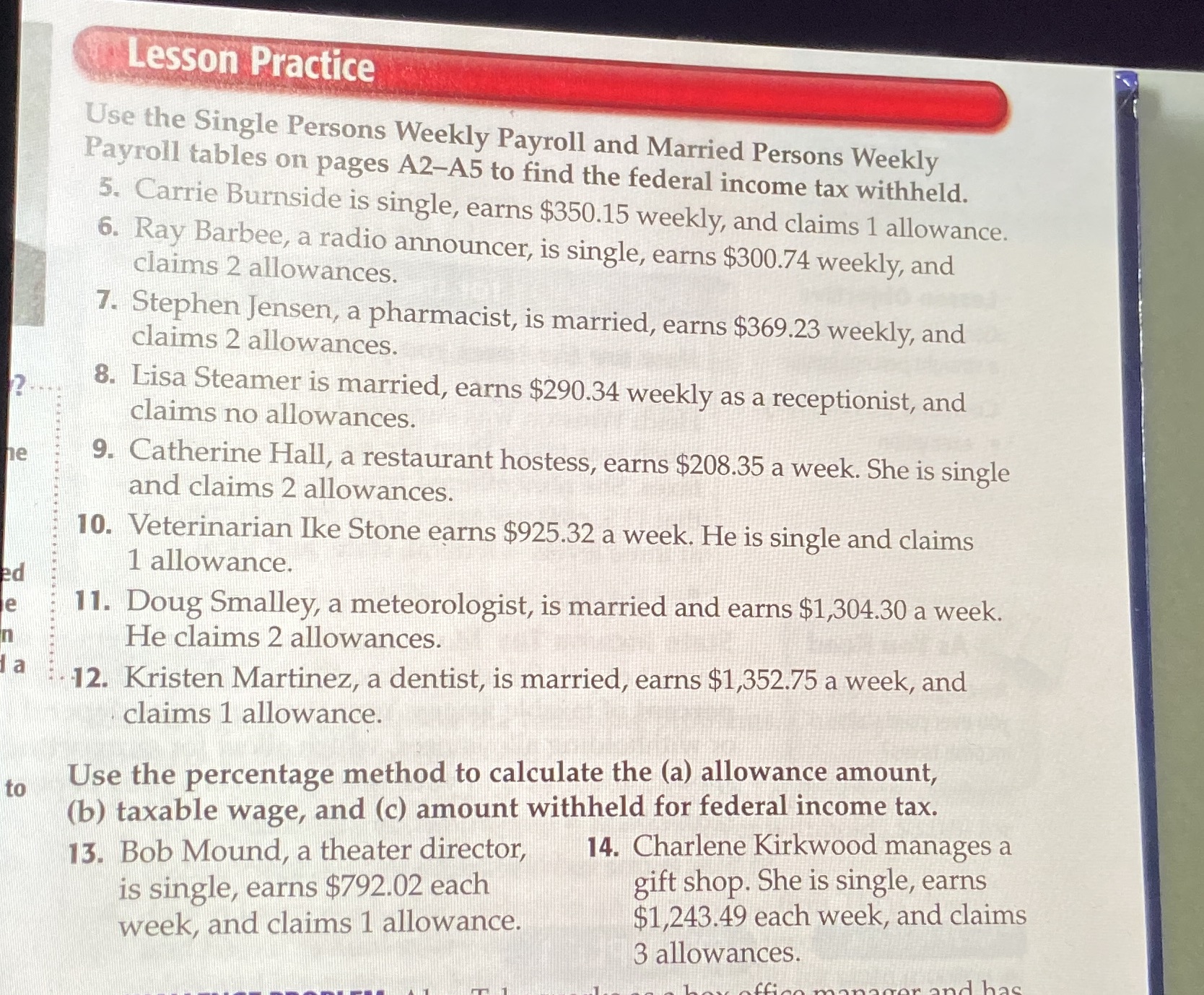

Lesson Practice Use the Single Persons Weekly Payroll and Married Persons Weekly Payroll tables on pages A2-A5 to find the federal income tax withheld. 5. Carrie Burnside is single, earns $350.15 weekly, and claims 1 allowance. 6. Ray Barbee, a radio announcer, is single, earns $300.74 weekly, and claims 2 allowances. 7. Stephen Jensen, a pharmacist, is married, earns $369.23 weekly, and claims 2 allowances. 8. Lisa Steamer is married, earns $290.34 weekly as a receptionist, and claims no allowances. he 9. Catherine Hall, a restaurant hostess, earns $208.35 a week. She is single and claims 2 allowances. 10. Veterinarian Ike Stone earns $925.32 a week. He is single and claims 1 allowance. 11. Doug Smalley, a meteorologist, is married and earns $1,304.30 a week. He claims 2 allowances. 12. Kristen Martinez, a dentist, is married, earns $1,352.75 a week, and claims 1 allowance. Use the percentage method to calculate the (a) allowance amount, to (b) taxable wage, and (c) amount withheld for federal income tax. 13. Bob Mound, a theater director, 14. Charlene Kirkwood manages a is single, earns $792.02 each gift shop. She is single, earns week, and claims 1 allowance. $1,243.49 each week, and claims 3 allowances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts