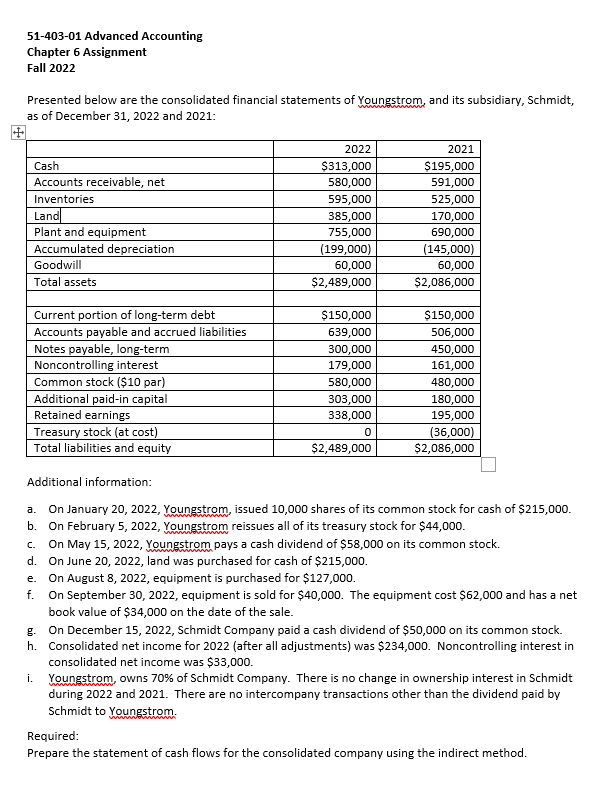

Question: 51-403-01 Advanced Accounting Chapter 6 Assignment Fall 2022 Presented below are the consolidated financial statements of Youngstrom, and its subsidiary, Schmidt, as of December 31,

51-403-01 Advanced Accounting Chapter 6 Assignment Fall 2022 Presented below are the consolidated financial statements of Youngstrom, and its subsidiary, Schmidt, as of December 31, 2022 and 2021: Additional information: a. On January 20, 2022, Youngstrom, issued 10,000 shares of its common stock for cash of $215,000. b. On February 5, 2022, Youngstrom reissues all of its treasury stock for $44,000. c. On May 15, 2022, Youngstrom pays a cash dividend of $58,000 on its common stock. d. On June 20, 2022, land was purchased for cash of $215,000. e. On August 8, 2022, equipment is purchased for $127,000. f. On September 30,2022 , equipment is sold for $40,000. The equipment cost $62,000 and has a net book value of $34,000 on the date of the sale. g. On December 15, 2022, Schmidt Company paid a cash dividend of $50,000 on its common stock. h. Consolidated net income for 2022 (after all adjustments) was $234,000. Noncontrolling interest in consolidated net income was $33,000. i. Youngstrom, owns 70% of Schmidt Company. There is no change in ownership interest in Schmidt during 2022 and 2021 . There are no intercompany transactions other than the dividend paid by Schmidt to Youngstrom. Required: Prepare the statement of cash flows for the consolidated company using the indirect method. 51-403-01 Advanced Accounting Chapter 6 Assignment Fall 2022 Presented below are the consolidated financial statements of Youngstrom, and its subsidiary, Schmidt, as of December 31, 2022 and 2021: Additional information: a. On January 20, 2022, Youngstrom, issued 10,000 shares of its common stock for cash of $215,000. b. On February 5, 2022, Youngstrom reissues all of its treasury stock for $44,000. c. On May 15, 2022, Youngstrom pays a cash dividend of $58,000 on its common stock. d. On June 20, 2022, land was purchased for cash of $215,000. e. On August 8, 2022, equipment is purchased for $127,000. f. On September 30,2022 , equipment is sold for $40,000. The equipment cost $62,000 and has a net book value of $34,000 on the date of the sale. g. On December 15, 2022, Schmidt Company paid a cash dividend of $50,000 on its common stock. h. Consolidated net income for 2022 (after all adjustments) was $234,000. Noncontrolling interest in consolidated net income was $33,000. i. Youngstrom, owns 70% of Schmidt Company. There is no change in ownership interest in Schmidt during 2022 and 2021 . There are no intercompany transactions other than the dividend paid by Schmidt to Youngstrom. Required: Prepare the statement of cash flows for the consolidated company using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts