Question: 51:54 Hide Timer Question 5 View Policies Current Attempt in Progress Indigo Ltd. purchased a building on January 1, 2018 for $15,990,000. Indigo accounted for

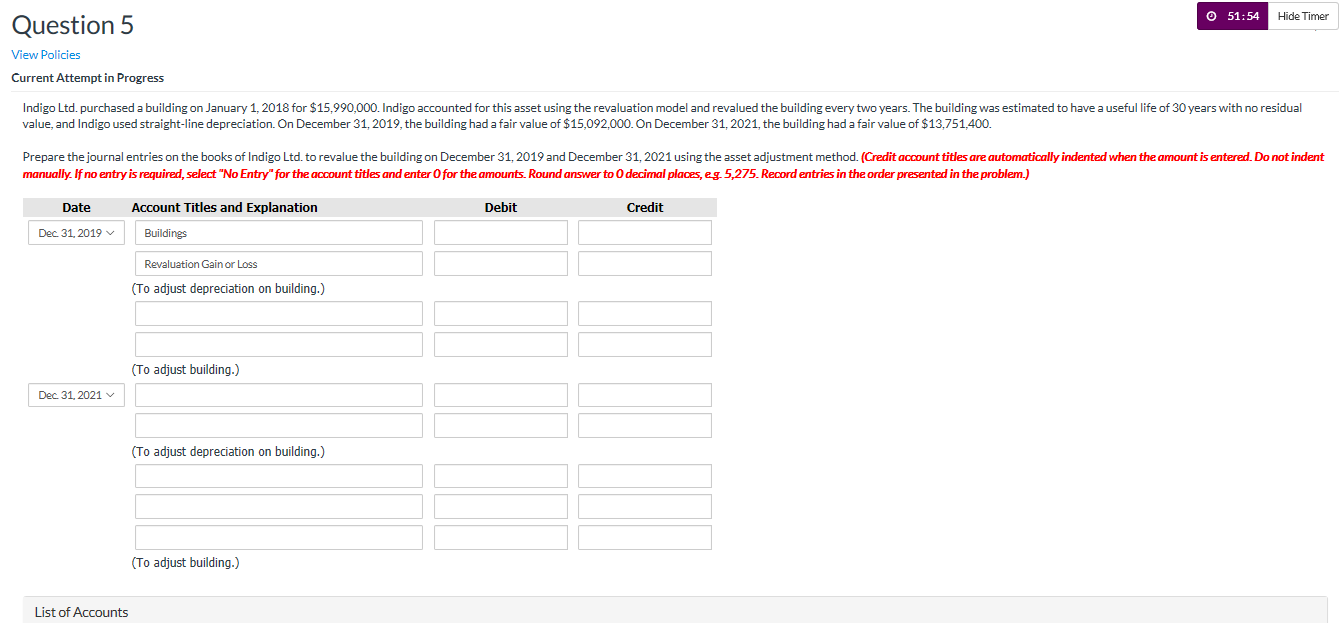

51:54 Hide Timer Question 5 View Policies Current Attempt in Progress Indigo Ltd. purchased a building on January 1, 2018 for $15,990,000. Indigo accounted for this asset using the revaluation model and revalued the building every two years. The building was estimated to have a useful life of 30 years with no residual value, and Indigo used straight-line depreciation. On December 31, 2019, the building had a fair value of $15,092,000. On December 31, 2021, the building had a fair value of $13,751,400. Prepare the journal entries on the books of Indigo Ltd. to revalue the building on December 31, 2019 and December 31, 2021 using the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter Ofor the amounts. Round answer to 0 decimal places, eg 5,275. Record entries in the order presented in the problem.) Date Debit Credit Account Titles and Explanation Buildings Dec 31, 2019 Revaluation Gain or Loss (To adjust depreciation on building.) (To adjust building.) Dec 31, 2021 (To adjust depreciation on building.) (To adjust building.) List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts