Question: 516 CHAPTER 9 ADV SECTION 9.5 9.5.1 The current spot price of platinum is $2000 per ounce. The one year continuously compounded risk-free rate of

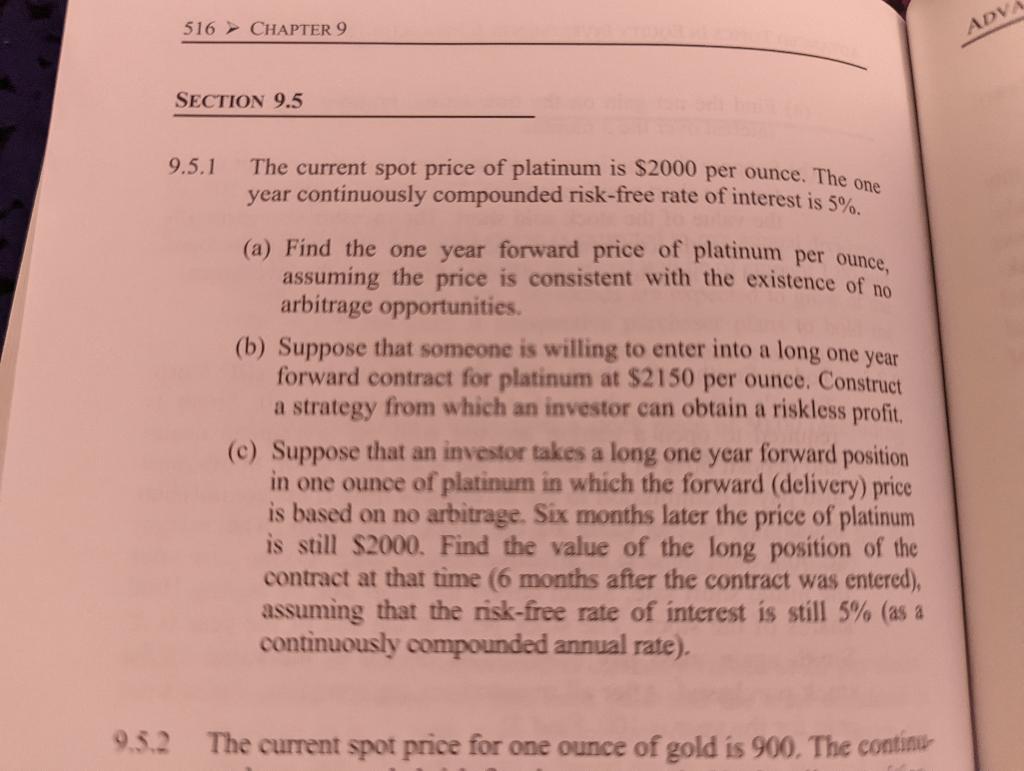

516 CHAPTER 9 ADV SECTION 9.5 9.5.1 The current spot price of platinum is $2000 per ounce. The one year continuously compounded risk-free rate of interest is 5%. (a) Find the one year forward price of platinum per ounce, assuming the price is consistent with the existence of no arbitrage opportunities. (b) Suppose that someone is willing to enter into a long one year forward contract for platinum at $2150 per ounce. Construct a strategy from which an investor can obtain a riskless profit . (e) Suppose that an investor takes a long one year forward position in one ounce of platinum in which the forward (delivery) price is based on no arbitrage. Six months later the price of platinum is still $2000. Find the value of the long position the contract at that time (6 months after the contract was entered), assuming that the risk-free rate of interest is still 5% (as a continuously compounded annual rate). a 9.5.2 The current spot price for one ounce of gold is 900. The continu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts