Question: 52. LO.6 & LO.7 (Absorption vs. variable costing) Tomm's T's is a New York-based company that produces and sells t-shirts. The firm uses variable

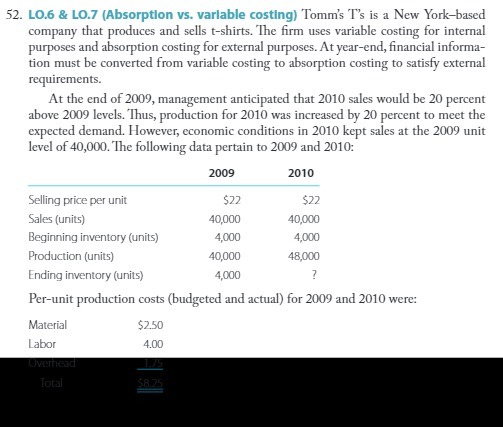

52. LO.6 & LO.7 (Absorption vs. variable costing) Tomm's T's is a New York-based company that produces and sells t-shirts. The firm uses variable costing for internal purposes and absorption costing for external purposes. At year-end, financial informa- tion must be converted from variable costing to absorption costing to satisfy external requirements. At the end of 2009, management anticipated that 2010 sales would be 20 percent above 2009 levels. Thus, production for 2010 was increased by 20 percent to meet the expected demand. However, economic conditions in 2010 kept sales at the 2009 unit level of 40,000. The following data pertain to 2009 and 2010: 2009 2010 Selling price per unit $22 $22 Sales (units) 40,000 40,000 Beginning inventory (units) 4,000 4,000 Production (units) 40,000 48,000 Ending inventory (units) 4,000 ? Per-unit production costs (budgeted and actual) for 2009 and 2010 were: Material $2.50 Labor 4.00 Overhead 1.75 Total $8.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts