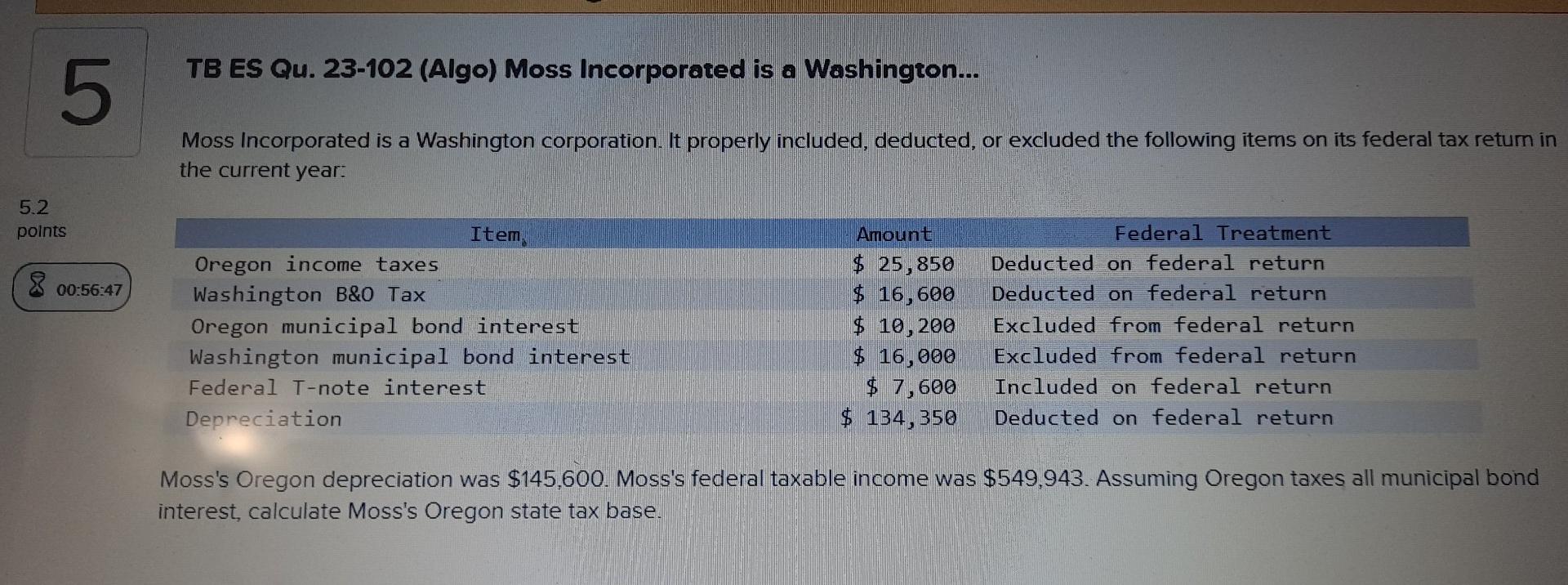

Question: 5.2 points 5 TB ES Qu. 23-102 (Algo) Moss Incorporated is a Washington... Moss Incorporated is a Washington corporation. It properly included, deducted, or

5.2 points 5 TB ES Qu. 23-102 (Algo) Moss Incorporated is a Washington... Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year: Item Oregon income taxes. 8 00:56:47 Washington B&O Tax Oregon municipal bond interest Washington municipal bond interest Federal T-note interest Depreciation Amount $ 25,850 Federal Treatment Deducted on federal return $ 16,600 Deducted on federal return $ 10,200 $ 16,000 $ 7,600 $ 134,350 Excluded from federal return Excluded from federal return Included on federal return Deducted on federal return Moss's Oregon depreciation was $145,600. Moss's federal taxable income was $549,943. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts