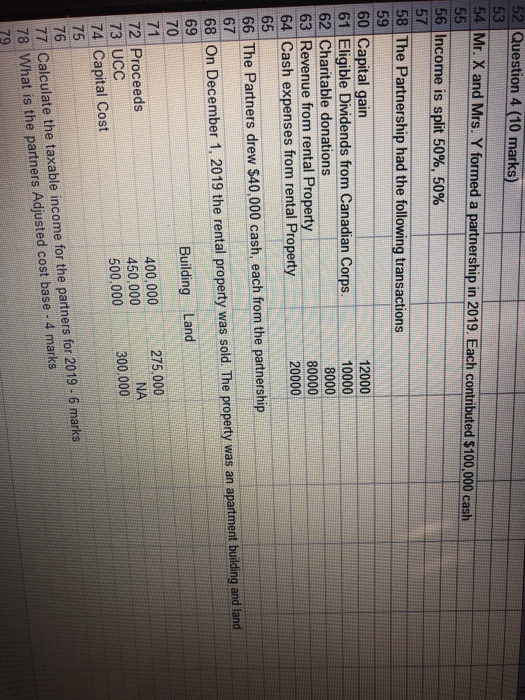

Question: 52 Question 4 (10 marks) 53 54 Mr. X and Mrs. Y formed a partnership in 2019. Each contributed $100,000 cash 55 56 Income is

52 Question 4 (10 marks) 53 54 Mr. X and Mrs. Y formed a partnership in 2019. Each contributed $100,000 cash 55 56 Income is split 50%, 50% 57 58 The Partnership had the following transactions 59 60 Capital gain 12000 61 Eligible Dividends from Canadian Corps. 10000 62 Charitable donations 8000 63 Revenue from rental Property 80000 64 Cash expenses from rental Property 20000 65 66 The Partners drew $40,000 cash, each from the partnership 67 68 On December 1, 2019 the rental property was sold. The property was an apartment building and land 69 Building Land 71 400,000 275,000 72 Proceeds 450.000 NA 73 UCC 500.000 300.000 74 Capital Cost 75 76 77 Calculate the taxable income for the partners for 2019 - 6 marks 78 What is the partners Adjusted cost base - 4 marks 52 Question 4 (10 marks) 53 54 Mr. X and Mrs. Y formed a partnership in 2019. Each contributed $100,000 cash 55 56 Income is split 50%, 50% 57 58 The Partnership had the following transactions 59 60 Capital gain 12000 61 Eligible Dividends from Canadian Corps. 10000 62 Charitable donations 8000 63 Revenue from rental Property 80000 64 Cash expenses from rental Property 20000 65 66 The Partners drew $40,000 cash, each from the partnership 67 68 On December 1, 2019 the rental property was sold. The property was an apartment building and land 69 Building Land 71 400,000 275,000 72 Proceeds 450.000 NA 73 UCC 500.000 300.000 74 Capital Cost 75 76 77 Calculate the taxable income for the partners for 2019 - 6 marks 78 What is the partners Adjusted cost base - 4 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts