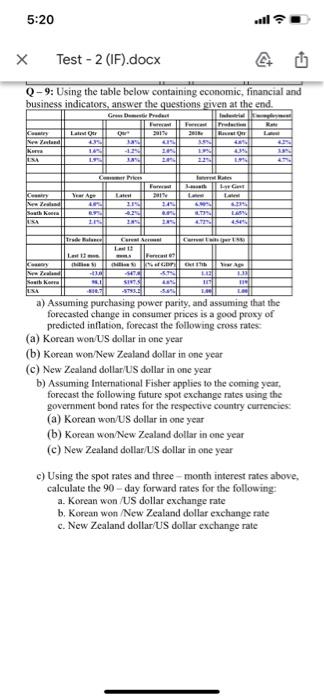

Question: 5:20 9. Test - 2 (IF).docx Q-9: Using the table below containing economic, financial and business indicators, answer the questions given at the end. Traduction

5:20 9. Test - 2 (IF).docx Q-9: Using the table below containing economic, financial and business indicators, answer the questions given at the end. Traduction Grade La Otro Nerd Priors LG Ver re est II INI - TI LAU 444 Tell La 11 MONGO - 3 11 Sastor 3891 SIRSIT -3793 a) Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following cross rates (a) Korean won US dollar in one year (b) Korean won/New Zealand dollar in one year (c) New Zealand dollar/US dollar in one year b) Assuming International Fisher applies to the coming year, forecast the following future spot exchange rates using the government bond rates for the respective country currencies (a) Korean won/US dollar in one year (b) Korean won/New Zealand dollar in one year (c) New Zealand dollar/US dollar in one year c) Using the spot rates and three month interest rates above, calculate the 90 - day forward rates for the following: a. Korean won US dollar exchange rate b. Korean won New Zealand dollar exchange rate c. New Zealand dollar US dollar exchange rate 5:20 9. Test - 2 (IF).docx Q-9: Using the table below containing economic, financial and business indicators, answer the questions given at the end. Traduction Grade La Otro Nerd Priors LG Ver re est II INI - TI LAU 444 Tell La 11 MONGO - 3 11 Sastor 3891 SIRSIT -3793 a) Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following cross rates (a) Korean won US dollar in one year (b) Korean won/New Zealand dollar in one year (c) New Zealand dollar/US dollar in one year b) Assuming International Fisher applies to the coming year, forecast the following future spot exchange rates using the government bond rates for the respective country currencies (a) Korean won/US dollar in one year (b) Korean won/New Zealand dollar in one year (c) New Zealand dollar/US dollar in one year c) Using the spot rates and three month interest rates above, calculate the 90 - day forward rates for the following: a. Korean won US dollar exchange rate b. Korean won New Zealand dollar exchange rate c. New Zealand dollar US dollar exchange rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts