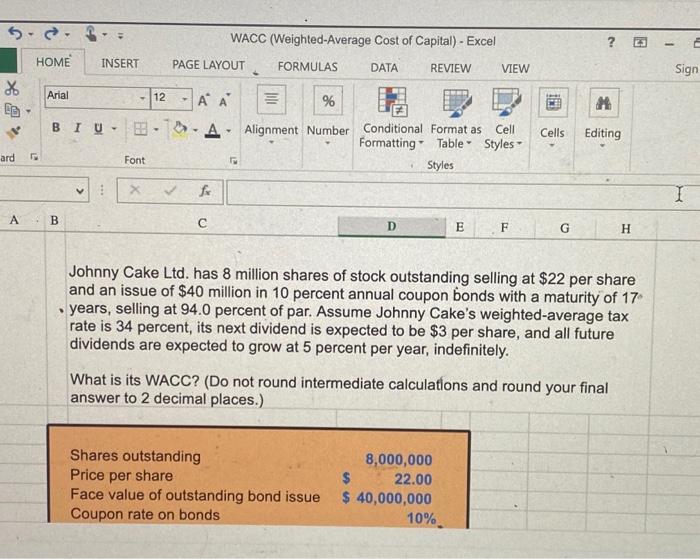

Question: 5.2.1 HOME * ard A Arial B INSERT D % BIU A Alignment Number *** Font PAGE LAYOUT 12 T WACC (Weighted-Average Cost of Capital)

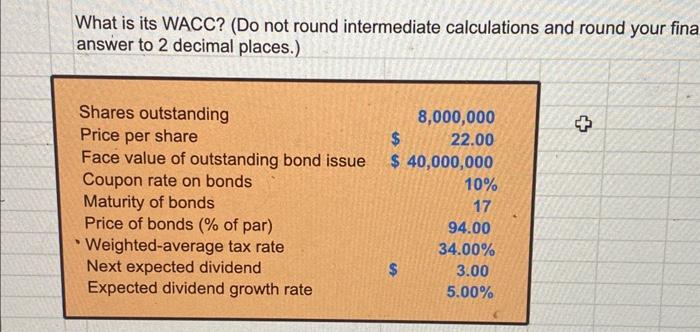

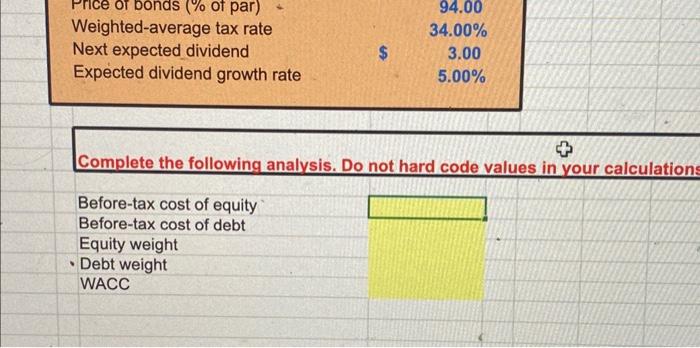

Johnny Cake Ltd. has 8 million shares of stock outstanding selling at \$22 per share and an issue of $40 million in 10 percent annual coupon bonds with a maturity of 17 - years, selling at 94.0 percent of par. Assume Johnny Cake's weighted-average tax rate is 34 percent, its next dividend is expected to be $3 per share, and all future dividends are expected to grow at 5 percent per year, indefinitely. What is its WACC? (Do not round intermediate calculations and round your final answer to 2 decimal places.) What is its WACC? (Do not round intermediate calculations and round your fina answer to 2 decimal places.) \&

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts