Question: 5229. 5227 . dear, only solve b , I already solve a. 5221. if can only tell me the answer of F , I solved

5229.

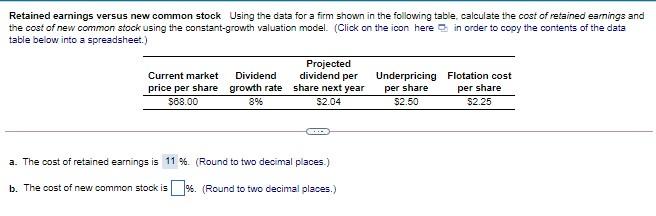

5227. dear, only solve b, I already solve a.

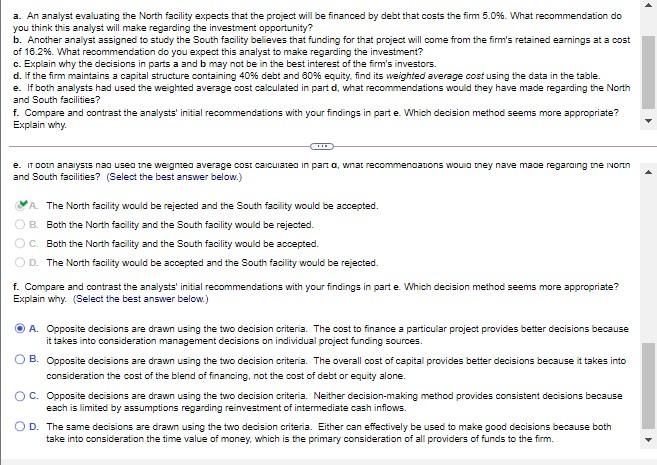

5221. if can only tell me the answer of F, I solved the rest of the questions. thanks in advance, I will give you a thumbs up.

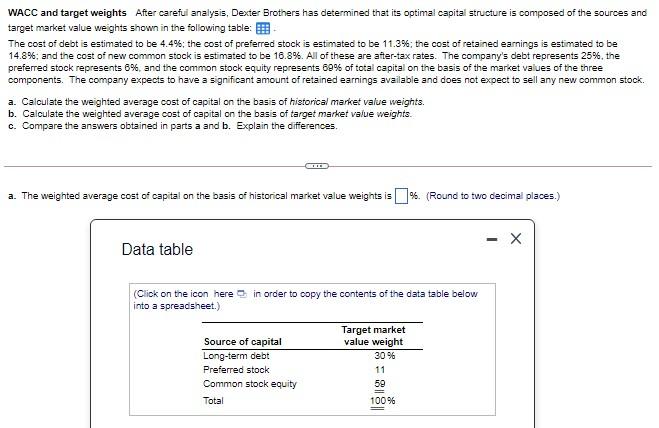

WACC and target weights After careful analysis, Dexter Brothers has determined that its optimal capital structure is composed of the sources and target market value weights shown in the following table: The cost of debt is estimated to be 4.4%; the cost of preferred stock is estimated to be 11.3%; the cost of retained earnings is estimated to be 14.8%; and the cost of new common stock is estimated to be 16.8%. All of these are after-tax rates. The company's debt represents 25%, the preferred stock represents 6%, and the common stock equity represents 60% of total capital on the basis of the market values of the three components. The company expects to have a significant amount of retained earnings available and does not expect to sell any new common stock. a. Calculate the weighted average cost of capital on the basis of historical market value weights. b. Calculate the weighted average cost of capital on the basis of target market value weights. c. Compare the answers obtained in parts a and b. Explain the differences. a. The weighted average cost of capital on the basis of historical market value weights is %. (Round to two decimal places.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Source of capital Long-term debt Target market value weight 30% Preferred stock Common stock equity Total = 100% 11 59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts