Question: 5.31 Consider two mutually exclusive investment projects, each with MARR = 12%, as shown in Table 5.31. (a) On the basis of the NPW criterion,

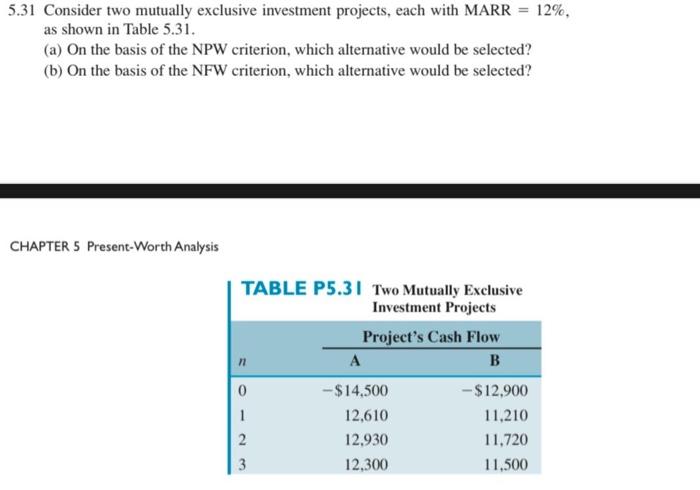

5.31 Consider two mutually exclusive investment projects, each with MARR = 12%, as shown in Table 5.31. (a) On the basis of the NPW criterion, which alternative would be selected? (b) On the basis of the NFW criterion, which alternative would be selected? CHAPTER 5 Present-Worth Analysis n TABLE P5.31 Two Mutually Exclusive Investment Projects Project's Cash Flow A B 0 -$14,500 -$12.900 1 12,610 11,210 2 12.930 11.720 12,300 11.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts