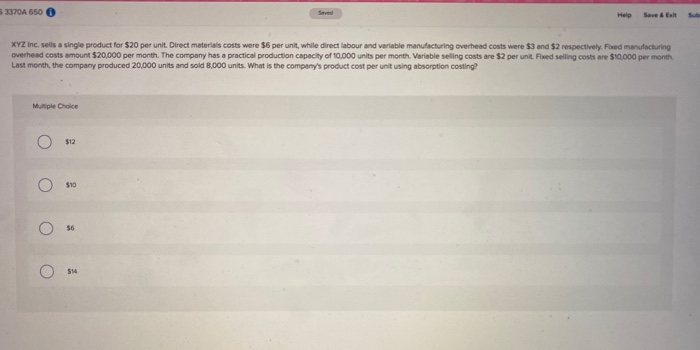

Question: 53370A 650 Help Save & Ext XYZinc, sells a single product for $20 per unit. Direct materials costs were $6 per unit, while direct labour

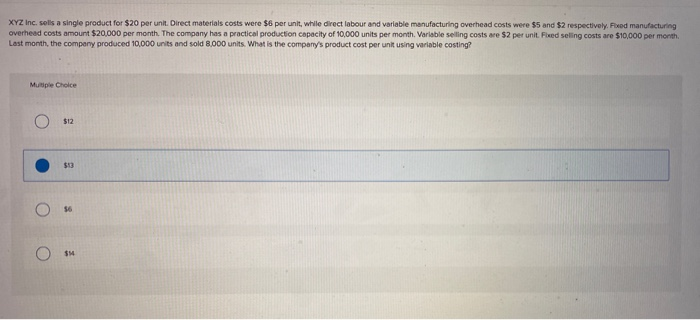

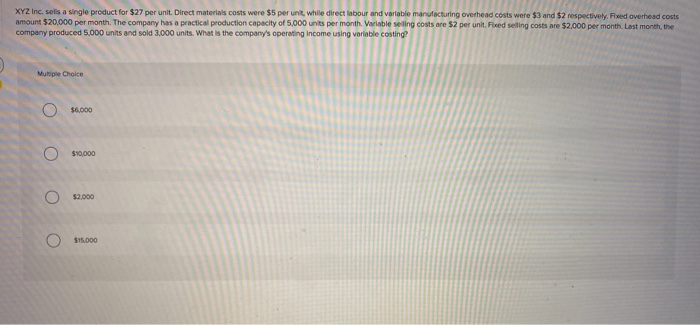

53370A 650 Help Save & Ext XYZinc, sells a single product for $20 per unit. Direct materials costs were $6 per unit, while direct labour and variable manufacturing overhead costs were $3 and $2 respectively. Fixed manufacturing overhead costs amount $20,000 per month. The company has a practical production capacity of 10,000 units per month. Variable selling costs are $2 per unt. Fixed selling costs are $10,000 per month Last month, the company produced 20,000 units and sold 8,000 units. What is the company's product cost per unit using absorption costing? Multiple Choice $12 $10 $6 O 514 XYZ Inc. sells a single product for $20 per unit. Direct materials costs were $6 per unit, while direct labour and variable manufacturing overhead costs were $5 and $2 respectively. Food manufacturing overhead costs amount $20,000 per month. The company has a practical production capacity of 10,000 units per month. Variable selling costs are $2 per unit. Fixed selling costs are $10,000 per month Last month, the company produced 10,000 units and sold 8,000 units. What is the company's product cost per unit using variable costing? Multiple Choice $12 $13 56 SM XYZinc, sells a single product for $27 per unit. Direct materials costs were $5 per unit, while direct labour and variable manufacturing overhead costs were $3 and $2 respectively. Fixed overhead costs amount $20,000 per month. The company has a practical production capacity of 5,000 units per month. Variable seling costs are $2 per unit. Fixed selling costs are $2,000 per month Last month, the company produced 5,000 units and sold 3.000 units. What is the company's operating income using variable costing? Multiple Choice O $6,000 $10,000 O $2.000 $15.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts