Question: 5:34 ..1 LTE O Notes Question 2: On November 1, 2019, Mr. Daniel Kim, an individual stock investor, pays attention to the news that Dongguk

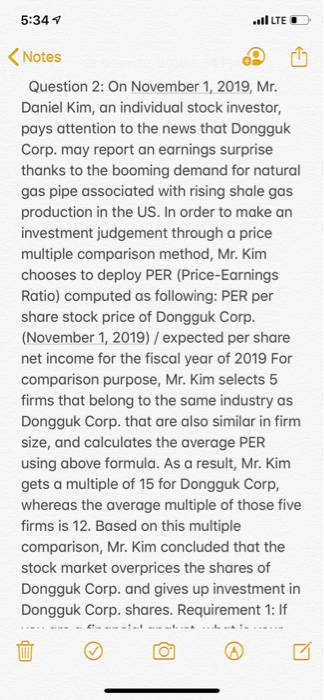

5:34 ..1 LTE O Notes Question 2: On November 1, 2019, Mr. Daniel Kim, an individual stock investor, pays attention to the news that Dongguk Corp. may report an earnings surprise thanks to the booming demand for natural gas pipe associated with rising shale gas production in the US. In order to make an investment judgement through a price multiple comparison method, Mr. Kim chooses to deploy PER (Price-Earnings Ratio) computed as following: PER per share stock price of Dongguk Corp. (November 1, 2019) / expected per share net income for the fiscal year of 2019 For comparison purpose, Mr. Kim selects 5 firms that belong to the same industry as Dongguk Corp. that are also similar in firm size, and calculates the average PER using above formula. As a result, Mr. Kim gets a multiple of 15 for Dongguk Corp, whereas the average multiple of those five firms is 12. Based on this multiple comparison, Mr. Kim concluded that the stock market overprices the shares of Dongguk Corp. and gives up investment in Dongguk Corp. shares. Requirement 1: If 5:34 ..1 LTE O Notes Question 2: On November 1, 2019, Mr. Daniel Kim, an individual stock investor, pays attention to the news that Dongguk Corp. may report an earnings surprise thanks to the booming demand for natural gas pipe associated with rising shale gas production in the US. In order to make an investment judgement through a price multiple comparison method, Mr. Kim chooses to deploy PER (Price-Earnings Ratio) computed as following: PER per share stock price of Dongguk Corp. (November 1, 2019) / expected per share net income for the fiscal year of 2019 For comparison purpose, Mr. Kim selects 5 firms that belong to the same industry as Dongguk Corp. that are also similar in firm size, and calculates the average PER using above formula. As a result, Mr. Kim gets a multiple of 15 for Dongguk Corp, whereas the average multiple of those five firms is 12. Based on this multiple comparison, Mr. Kim concluded that the stock market overprices the shares of Dongguk Corp. and gives up investment in Dongguk Corp. shares. Requirement 1: If

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts